70

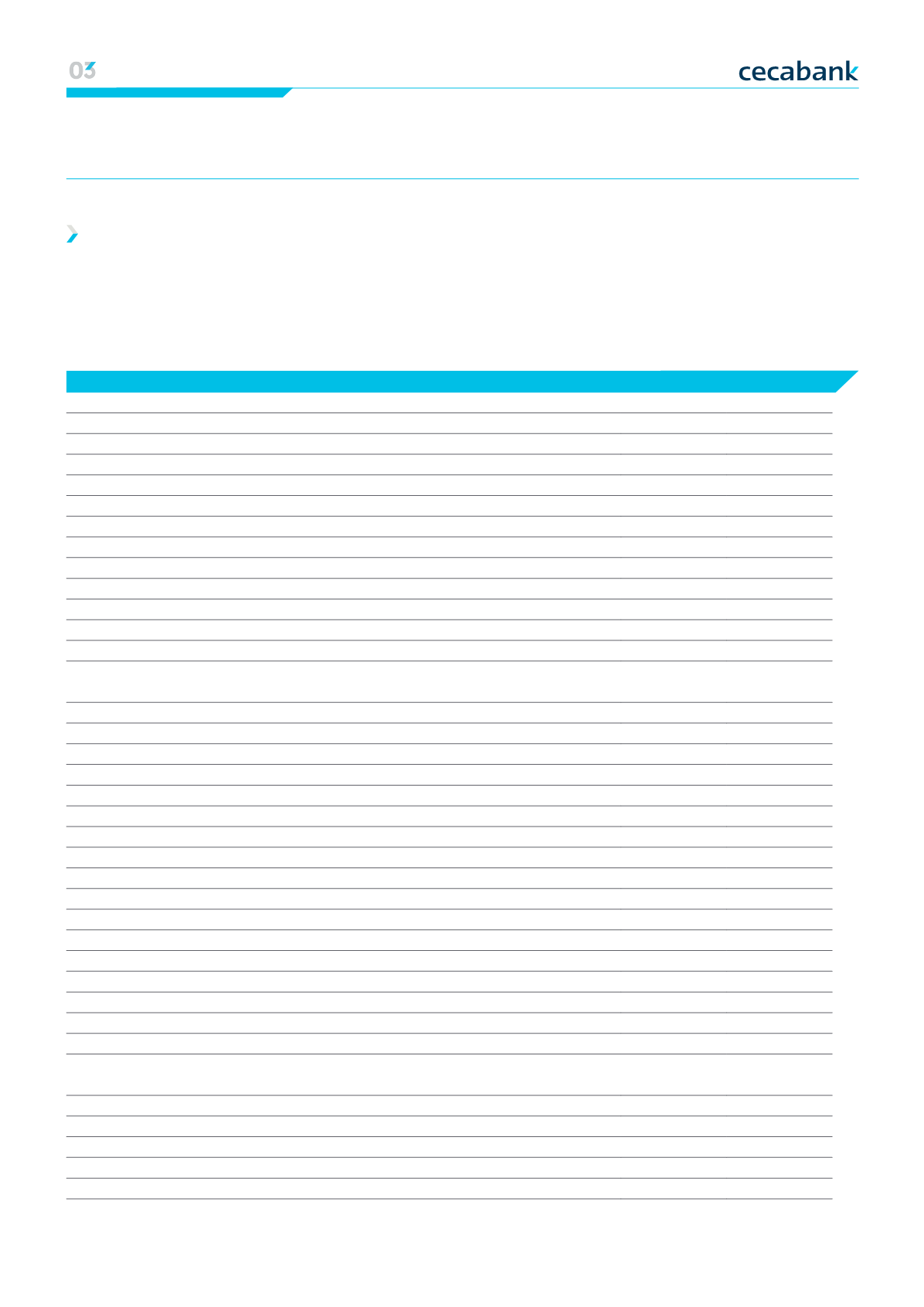

Annual Report 2014 Our Business ModelAt the end of 2014 Cecabank had 10,862 million in assets,

profit from the year of 54,4 million euros and

a CET1 ratio of 26.5 percent.

Activity

Assets

2014

2013 (*)

1. Cash and balances with central banks (Note 5)

196,387

393,402

2. Financial assets held for trading (Note 6.1)

2,832,794

4,444,621

2.1. Loans and advances to credit institutions

-

-

2.2. Loans and advances to customers

-

-

2.3. Debt instruments

1,046,083

923,365

2.4. Equity instruments

67,867

54,481

2.5. Trading derivatives

1,718,844

3,466,775

Memorandum item: Loaned or advanced as collateral

219,885

234,978

3. Other financial assets at fair value through profit or loss (Note 6.2)

3,624,938

2,341,993

3.1. Loans and advances to credit institutions

2,748,641

1,218,542

3.2. Loans and advances to customers

876,297

1,123,451

3.3. Debt instruments

-

-

3.4. Equity instruments

-

-

Memorandum item: Loaned or advanced as collateral

833,752

890,168

4. Available-for-sale financial assets (Note 7)

2,585,344

3,653,801

4.1. Debt instruments

2,523,149

3,610,111

4.2. Equity instruments

62,195

43,690

Memorandum entry: Lent or used as collateral

296,605

527,250

5. Loans and receivables (Note 8)

1,355,848

958,634

5.1 Deposits with credit institutions

923,917

572,341

5.2. Loans and advances to customers

389,102

308,867

5.3. Debt instruments

42,829

77,426

Memorandum item: Loaned or advanced as collateral

-

2,591

6. Held-to-maturity investments

-

-

Memorandum item: Loaned or advanced as collateral

-

-

7. Changes in the fair value of hedged items in portfolio hedges of interest rate risk

-

-

8. Hedging derivatives (Note 9)

19

242

9. Non-current assets held for sale (Note 10)

18,504

18,504

10. Investments (Note 11)

867

455

10.1. Associates

312

-

10.2. Jointly controlled entities

451

451

10.3. Subsidiaries

104

4

11. Insurance contracts linked to pensions

-

-

13. Tangible assets (Note 12)

53,232

54,809

13.1. Property plant and equipment

52,208

53,749

13.1.1. For own use

52,208

53,749

13.1.2. Leased out under an operating lease

-

-

13.1.3. Assigned to welfare projects

-

-

13.2. Investment property

1,024

1,060

Balance Sheet as at 31 December 2014 and 2013

00 Strategic lines |Economic and regulatory context | Strengthening our model

|

Business lines 01 Financial information|

Profit & loss | Activity|

Capital base | Ratings 02 Risk management | The Cecabank risk function