P.

14

2018 Pillar 3 Disclosures

Risk Management

2 | 2.2

Risk management departments

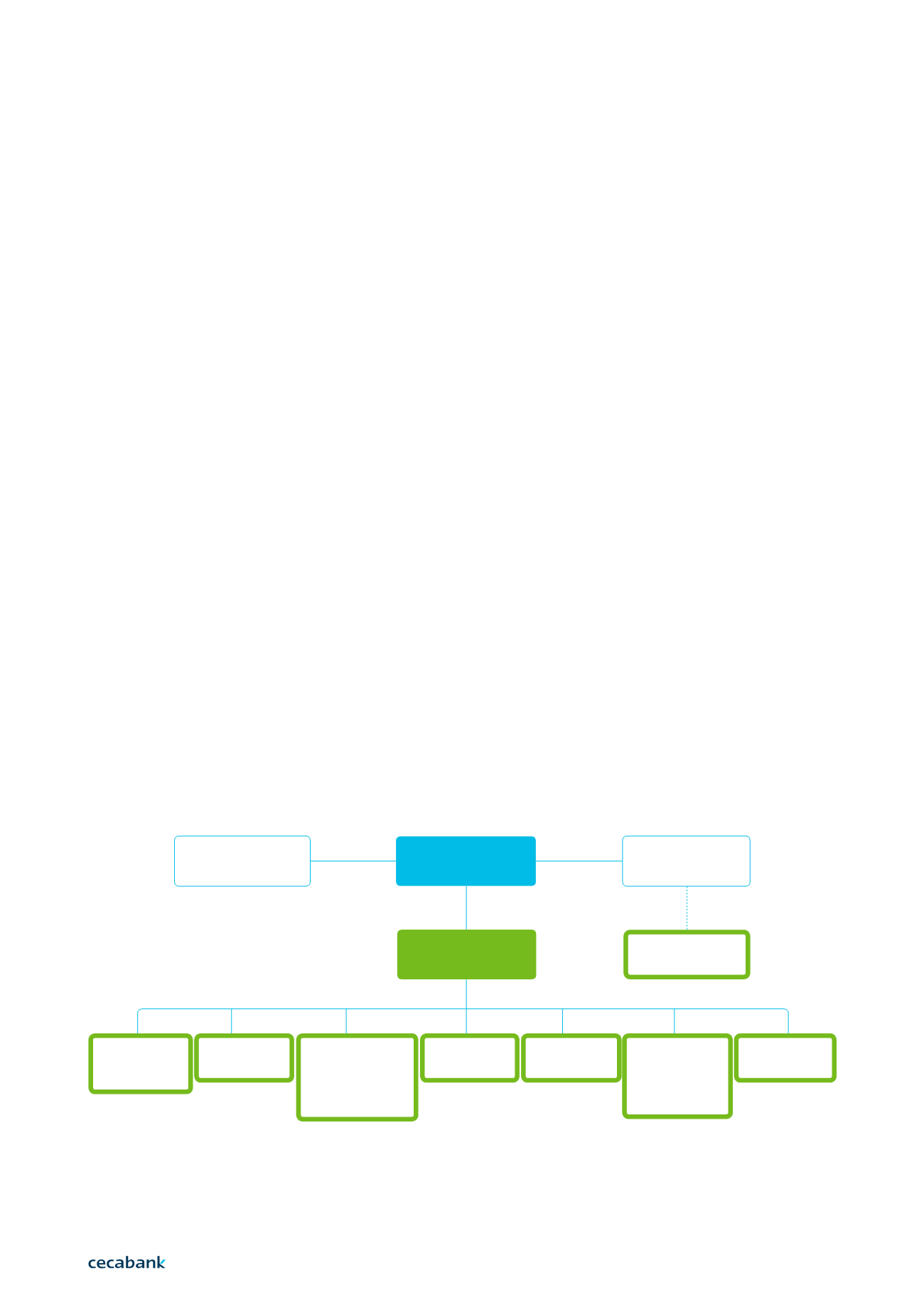

Article 38 of Act 10/2014 stipulates that credit institutions must have a unit that assumes the role

of risk management in proportion to the nature, scale and complexity of its activities.

Underpinned by the aforementioned principles, the structure of the risk function of Cecabank

is organised in order to comply with these requirements. Key requirements in this respect

include the independence of this unit from the ones under its supervision and control; holding a

relevant status, undertaking limited participation in decision-making processes; and having free

access to the Board of Directors, with sufficient resources to do so.

This section gives an overview of the structure of the bank’s risk function which, along with the

description of the procedures included in Annex I, demonstrates that Cecabank complies with the

aforementioned requirements enacted by Royal Decree 84/2015 and the Bank of Spain Circular

2/2016, as well as the Corporate Governance guidelines of the European Banking Authority.

Risk Department

The Risk Department is responsible for ensuring that the risk strategy is effectively implemented

through the development of policies, procedures, controls and systems which are appropriate, and

understood by the business areas assuming risks.

The Department is independent of the business areas, in both functional and hierarchical terms. Its

manager reports directly to the CEO and is actively involved in the Steering Committee, the Assets and

Liabilities Committee, and the Compliance and Operational Risk Committee.

Its position within the organisation has been established with the aim of ensuring the independence

and autonomy required so as to guarantee compliance with the objectives set.

2.2.4

2.2.4.1

Board of

Directors

Operational

Services

Department

Associate

Services,

Control and

Resources

Department

General

Secretariat

and Legal and

TAX Advice

Department

Planning

Department

Risk

Department

Internal

Audit

Financial

Department

Technology

Department

Risk

Committee

Audit

Committee

General

Management