P.

22

2018 Pillar 3 Disclosures

Capital

Annex IV includes a conciliation of the own fund items with the audited financial statements.

Tier 2 Capital

Tier 2 capital is understood as the factors defined in Part Two, Title I, Chapter 4 of Regulation

(EU) No. 575/2013, with the limits and deductions established in this chapter. These own funds,

although they comply with the definition of equity established in the regulations in force, are

characterised by having, in principle, greater volatility and a lower degree of permanence than

those elements classified as Tier 1 capital.

At 31 December 2018, the bank holds no Tier 2 capital. In previous years, the bank’s Tier 2

capital comprised the book value of the general allowance for customer insolvency risk. The

new IFRS 9 provides a new nature to this provision, excluding it from the elements forming part

of Tier 2 capital.

3.1.2

3 | 3.1

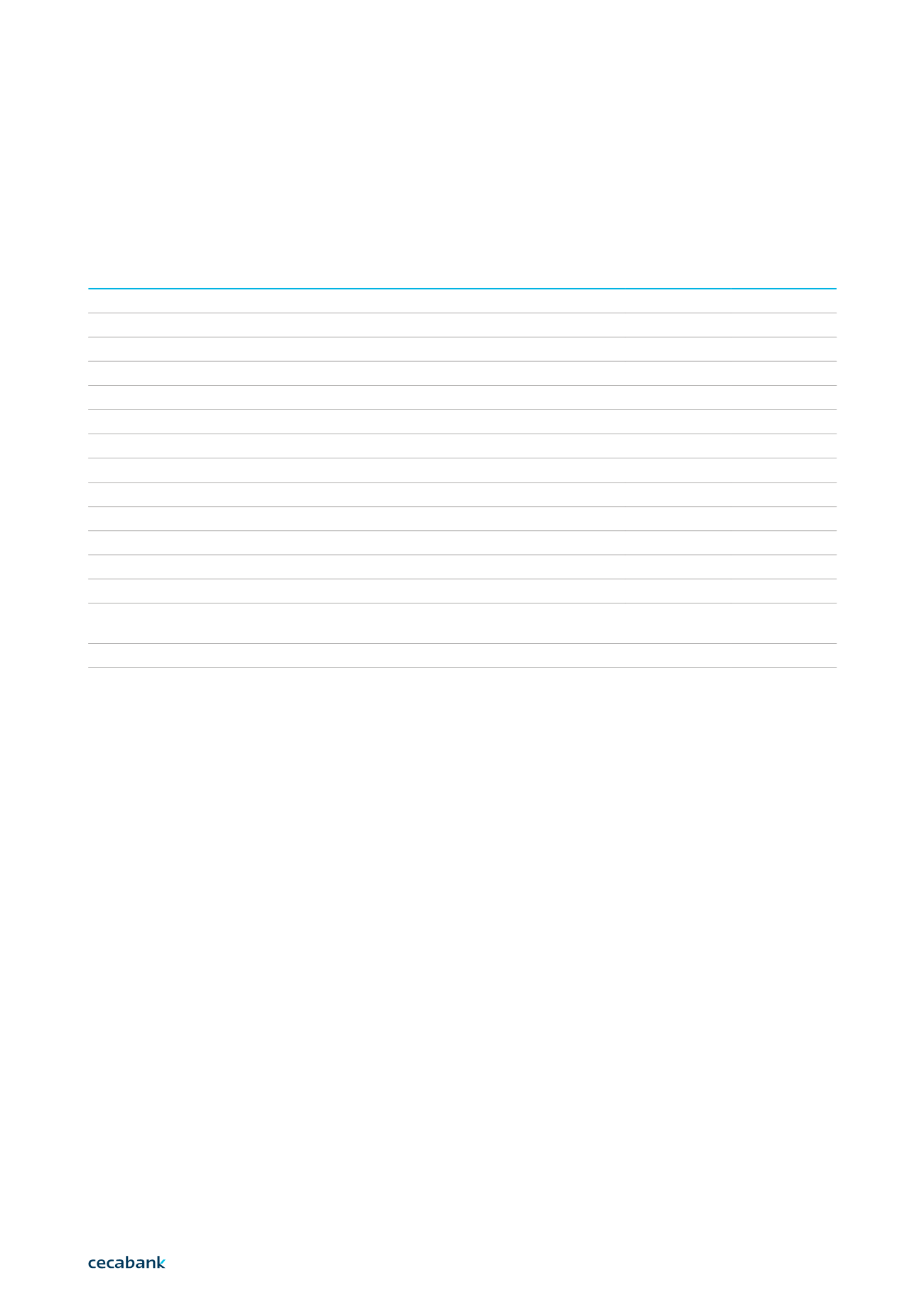

Item

Amount 2018 Amount 2017

Tier 1 Capital

791,312

724,332

Common Equity Tier 1 capital

791,312

724,332

Equity instruments eligible as Common Equity Tier 1 capital

727,750

727,750

Paid-up equity instruments

112,257

112,257

Share premium

615,493

615,493

Retained earnings

1

266,567

211,654

Retained earnings from previous years

266,567

211,654

Eligible profit

0

0

Accumulated other comprehensive income

9,768

45,058

Other reserves (IFRS9)

5,591

Common Equity Tier 1 capital reductions due to prudential filters

- 4,774

- 4,400

Other intangible assets (-)

- 205,402

- 228,864

Pension fund assets with defined benefits

- 8,188

- 7,506

Surplus of the elements deduced from additional Tier 1 capital with regard to additional

Tier 1 capital (-)

0

- 45,812

Other transitional adjustments of the Common Equity Tier 1 capital (-)

0

26,452

Thousands of euros.

1

This heading would have been increased by €42.5 million, if the results of 2018 that the Board of Directors decided to allocate to reserves had been included.