P.

26

2018 Pillar 3 Disclosures

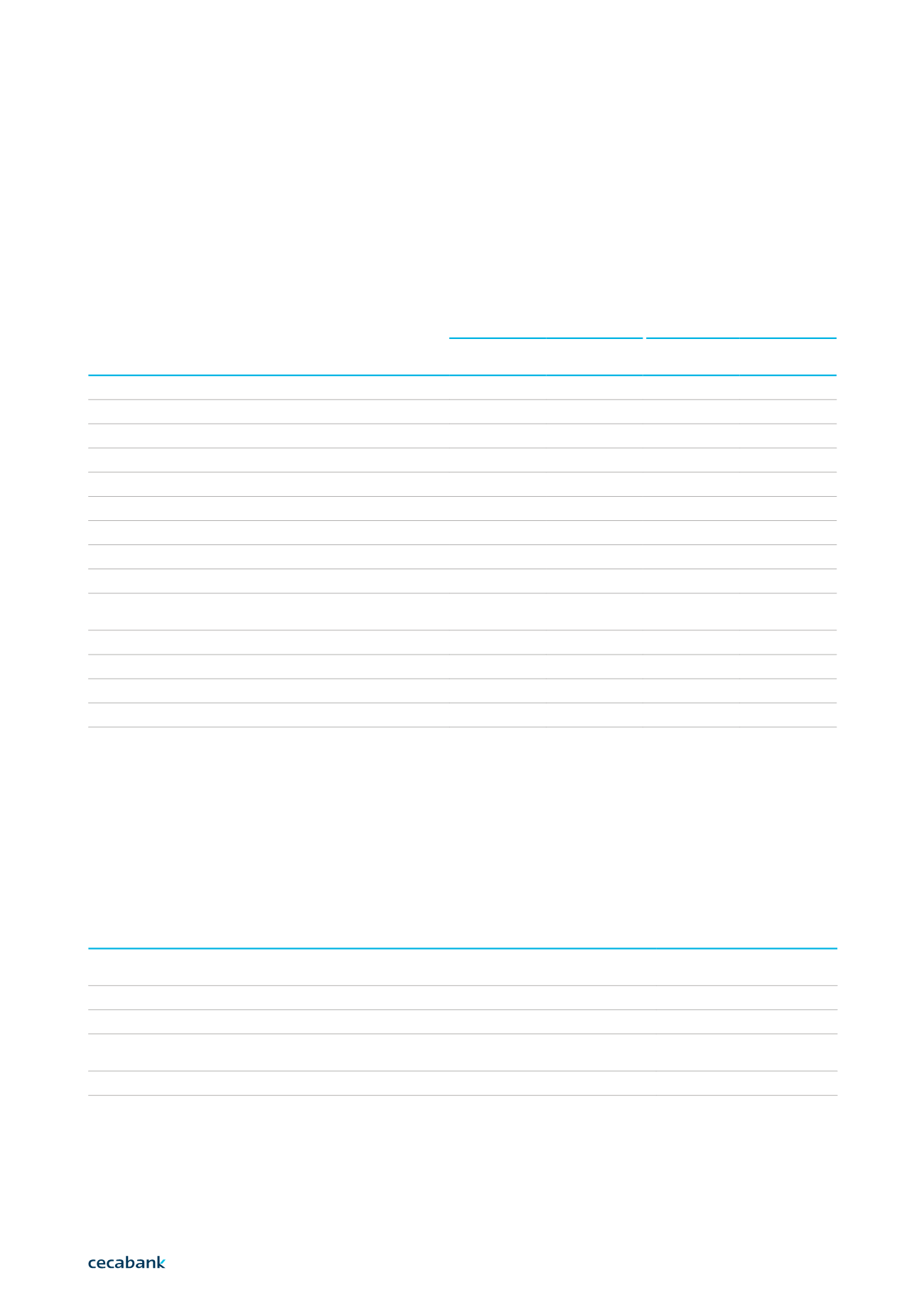

Capital

Risk Category

2018

2017

RWA

Capital

requirm.

RWA

Capital

requirm.

Central administrations or central banks

163,326

13,066

162,293

12,983

Regional administrations and local authorities

0

0

0

0

Public sector entities and other non-profit public institutions

5,109

409

15,555

1,244

Institutions

256,196

20,496

404,592

32,367

Corporates

280,165

22,413

210,391

16,831

Retail

6,298

504

6,725

538

Exposures secured by mortgages on immovable property

14,609

1,169

15,094

1,208

Exposures in default

1,034

82

604.5

48

Exposures associated with particularly high risk

0

0

6,747

540

Exposure to institutions and corporates with

a short-term credit assessment

2

0

38,500

3,080

Equity exposures

11,627

930

40,097

3,208

Other exposures

53,947

4,316

55,185

4,415

Securitisation exposures

23,926

1,914

137,139

10,971

Total

816,239

65,299

1,092,924

87,434

Thousands of euros.

3 | 3.2

The comparison of risk-weighted assets and consumption by credit risk and counterparty risk with

respect to the previous year are shown below:

Capital requirements for position risk

The table below shows the requirements for price risk of positions held in the bank’s trading book

at 31 December 2018, based on the method applied in its calculation:

3.2.2

Method applied

Capital

requirement

Position risk of debt instruments in the trading book calculated in accordance with the terms of Part

Three, Title IV, Chapter 2, Section 2 of Regulation (EU) No. 575/2013

51,062

- General risk (*)

45,958

- Specific risk:

5,104

Position risk in equity instruments calculated in accordance with Part Three, Title IV, Chapter 2,

Section 3 of Regulation (EU) No. 575/2013

8,764

Total capital requirements for price risk of the trading book

59,826

Thousands of euros.

(*) Calculated by applying the “maturity-based” method.