P.

32

2018 Pillar 3 Disclosures

Credit and dilution risks

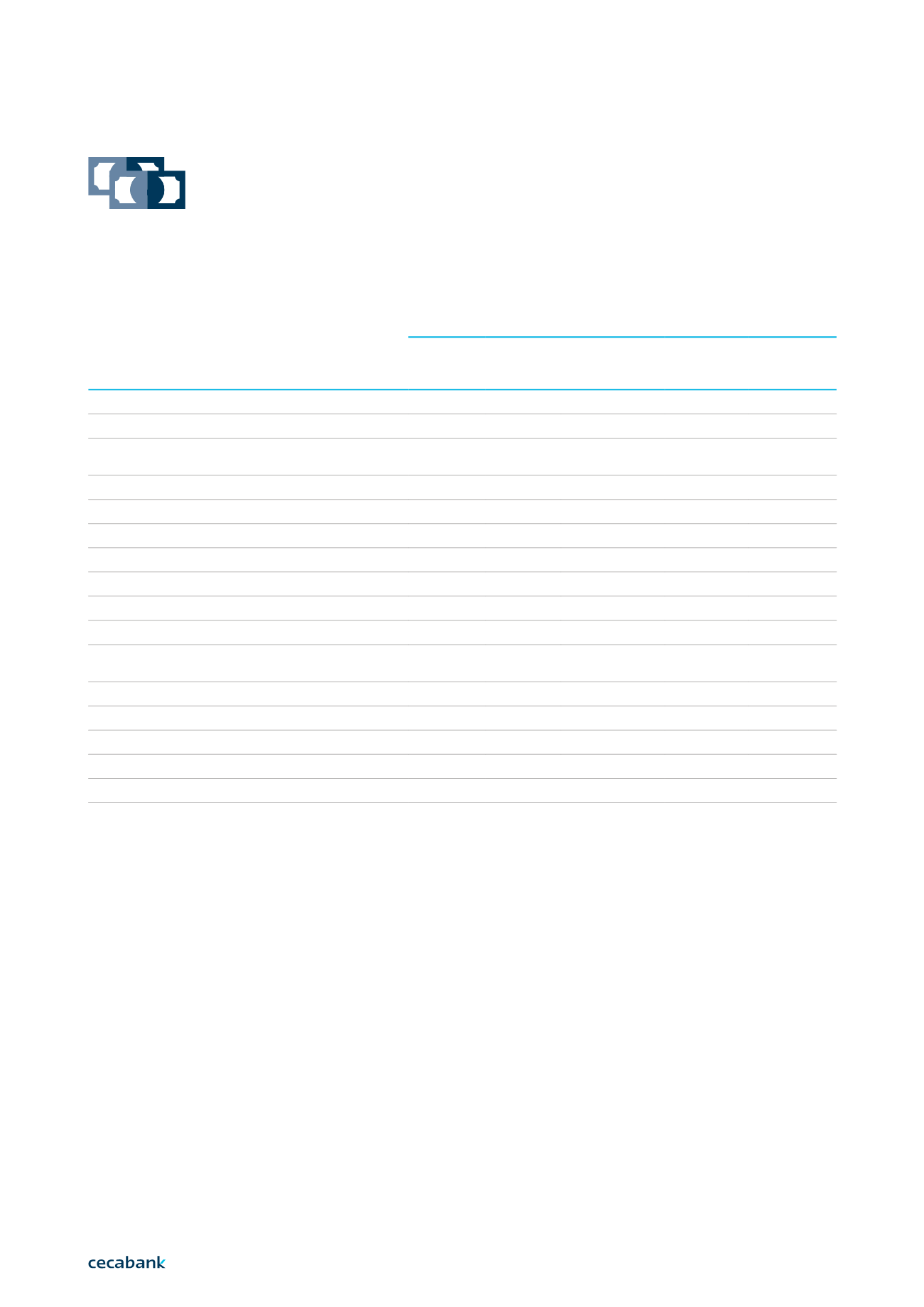

The following table sets out the distribution by residual maturity term of the exposures referred

to in section 4.1:

Residual maturity of the

exposures

4 | 4.3

Risk Category

Residual maturity at 31 December 2018

Current

Up to

3 months

Between

3 months

and a year

Between

1 and 5

years

More than

5 years

Central administrations or central banks

1,429

8,551

158,789

856,613

3,125,777

Regional administrations and local authorities

203

57,649

135,974

76,497

98,574

Public sector entities and other non-profit public

institutions

2,408

24

0

0

10,543

Institutions

588,263

3,048

12,017

53,780

178,283

Corporates

178,925

23,901

17,304

69,361

107,640

Retail

860

5

59

1,164

6,310

Exposures secured by mortgages on immovable property

0

0

23

641

41,075

Exposures in default

60

0

5

10

824

Exposures associated with particularly high risk

0

0

0

0

0

Covered bonds

0

0

0

0

0

Exposure to institutions and corporates with a short-

term credit assessment

4

0

0

0

0

Exposures to collective investment undertakings (CIU)

0

0

0

0

0

Equity exposures

11,627

0

0

0

0

Other exposures

168,036

0

0

0

4,927

Securitisation exposures

0

0

0

0

36,140

Exposure as at 31 December 2018

951,815 93,178

324,171 1,058,066 3,610,093

Thousands of euros.