P.

33

2018 Pillar 3 Disclosures

Credit and dilution risks

Counterparty credit risk

4 | 4.4

Counterparty credit risk is understood as the credit risk arising from derivatives, repurchase

operations, securities or commodities lending, margin lending transactions or long settlement

transactions carried out by the bank.

The details of the exposure to counterparty risk through derivative and securities financing

operations at 31 December 2018, are set out below:

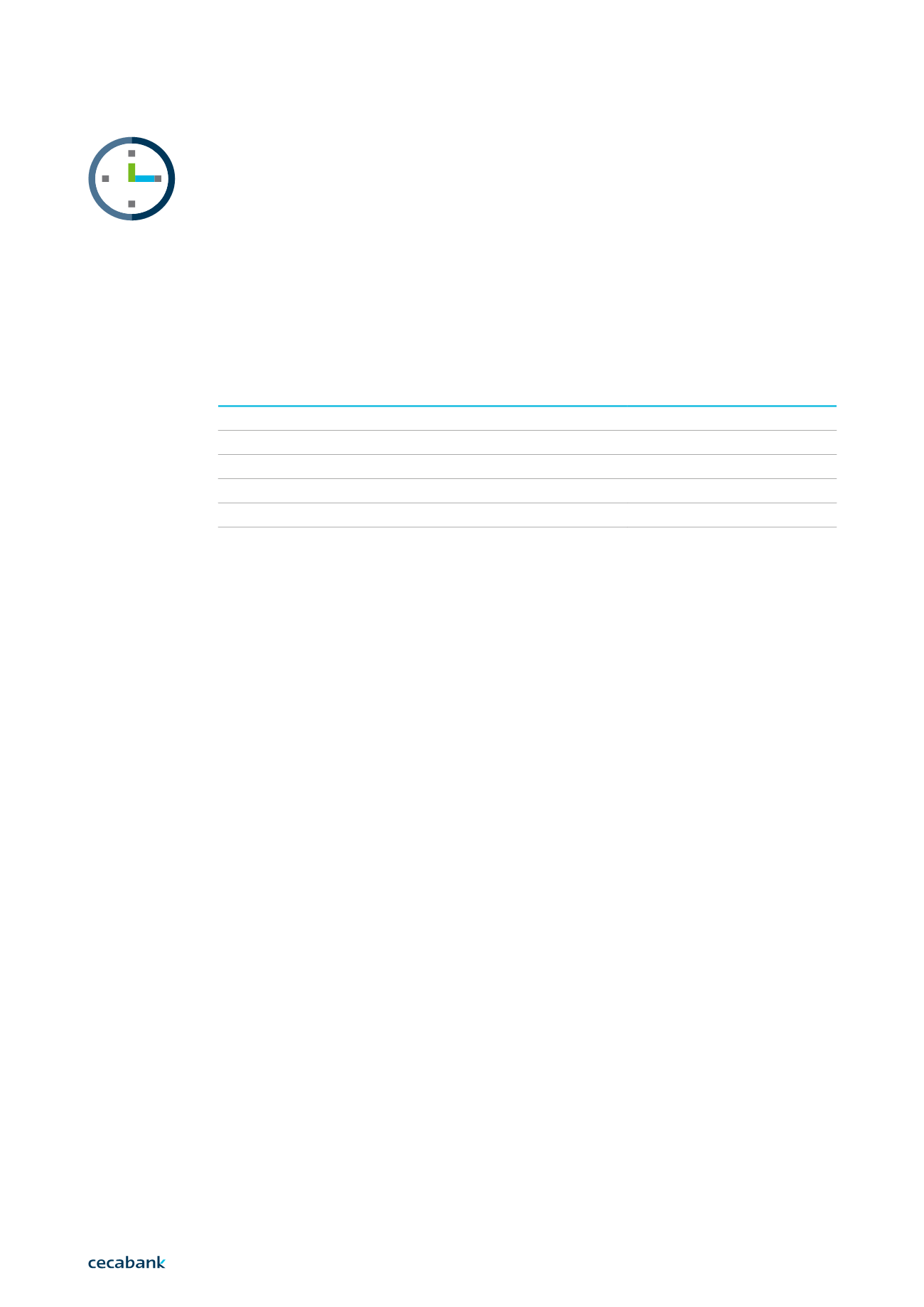

Measurements

Positive fair value of the contracts

1,524,690

Minus: Effect of netting agreements

1,320,154

Credit exposure after netting

204,536

Minus: Effect of the guarantees received

0

Credit exposure after netting and guarantees

204,536

Thousands of euros.

For the calculation of the minimum capital required associated with counterparty credit risk at

31 December 2018, the bank applied the market price valuation method, in accordance with the

terms of the standards set out in Part Three, Title II, Chapter 6 of Regulation (EU) No. 575/2013.

By way of summary, it can be stated that, for derivatives operations, the value of the exposure is

determined by adding the cost of replacement of all contracts with a positive value (established

by means of attribution of a market price to the contracts and operations) and the amount of

the potential future exposure of each instrument or operation, calculated in accordance with

the terms of Article 274 of Regulation (EU) No. 575/2013. In the calculation of the amount of the

potential risk, the scales contained in Table 1 of the aforementioned article were applied.

Credit derivatives

At year-end 2018, the bank held no credit derivatives.

Impact in collateral in the case of a reduction

in the bank’s credit rating

The impact is extremely low in view of the fact that practically all of the collateral agreements

currently in force do not have an agency rating as a factor that conditions the elements

contained therein. Of the five contracts that have the Minimum Transfer Amount linked to the

rating, three would be amended in the event the bank is at levels Baa1/BBB + or lower, and two

if the investment grade is lost. The impact on liquidity would not be considered relevant in any

of these cases.

4.4.1

4.4.2