P.

79

2018 Pillar 3 Disclosures

Annex

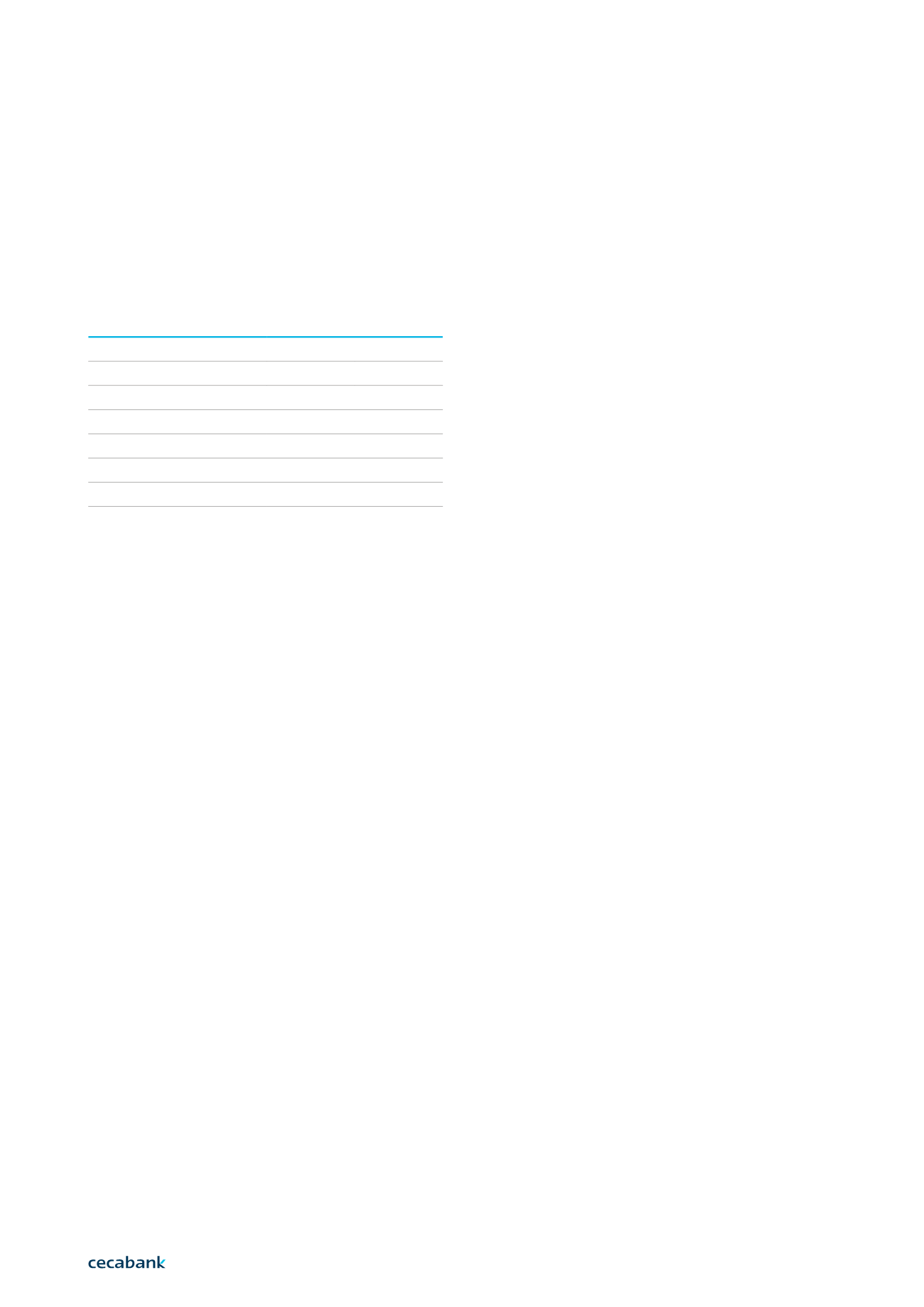

The mean distribution of the Trading Book VaR by desk

for 2018 and 2017:

2018

2017

Funding Desk and DPV

874

1,024

Forex Desk

550

390

Debt Desk

1,239

780

Equity Desk

257

527

Derivatives Desk

493

260

Credit Desk

165

135

Banknotes

21

27

In addition, an analytical measurement derived from

the VaR, known as the market risk Component VaR

is calculated and reported daily, serving to establish

the contribution to the total risk of each position and

market risk factor (risk concentration), approximating

the sensitivity of the VaR to variations in the portfolio

positions.

The component VaR can be obtained at a greater level

of breakdown and reported by:

•

Product.

•

Risk level.

Parametric VaR

With the aim of increasing the control over the VaR

historical simulation model, the parametric VaR is

calculated and reported daily to provide a point of

comparison for the risk estimate.

This methodology is based on statistical hypotheses of

normality in the distribution of probability of changes

in the risk factors. Using the historical series of

market prices (provided by the Market Data Service),

we calculate (in the market risk measurement tool)

the volatility and correlation between assets, which

together with the hypothesis of the distribution of

probability of changes provide an estimate of the

potential change of a position.

Expected shortfall

Another more advanced method supplementing market

risk measurements is the Expected Shortfall. The aim in

this case is to measure the expected loss in the event

that the VaR levels were to be exceeded. It therefore

quantifies the risk within the loss zone. This is an

asymmetric measurement which, unlike the VaR, not

only takes into consideration the frequency of losses

but also their magnitude in the event that the VaR were

exceeded.

Back testing

Monitoring tests to check the goodness-of-fit of the

market risk model are carried out; for this purpose,

clean and dirty back-testing studies are performed,

which help us demonstrate the suitability of this model

in the daily activity.

Contrast statistics

With the purpose of completing the models in further

detail and more effectively and complementing back-

testing, stricter goodness-of-fit tests are performed to

help identify possible inefficiencies in their calculation.

These tests are an essential tool to manage market risk,

especially when a part of it lies on the use of models

and systems that stem from a series of hypotheses that

require practical confirmation.

The metrics used are carried out on 2 levels:

•

General metrics applicable to all methodologies of

VaR calculation

•

Specific normality metrics applicable to parametric

methodologies

Management results

On the basis of the risk tools, the management results

for the trading books are calculated on a daily basis.

The criterion followed is mark-to-market for positions

with directly observable market prices (funds, bills,

futures, options on organised markets) and mark-to-

model (theoretical valuation) with market inputs for

operations without a quoted price (deposits, OTC

derivatives, etc.).

Sensitivity measurements

Although the limits are structured with regard to the

VaR measurement, which summarises all types of risks

and portfolios in a single indicator, there is a series of

supplementary measurements for the monitoring of

A|A.I