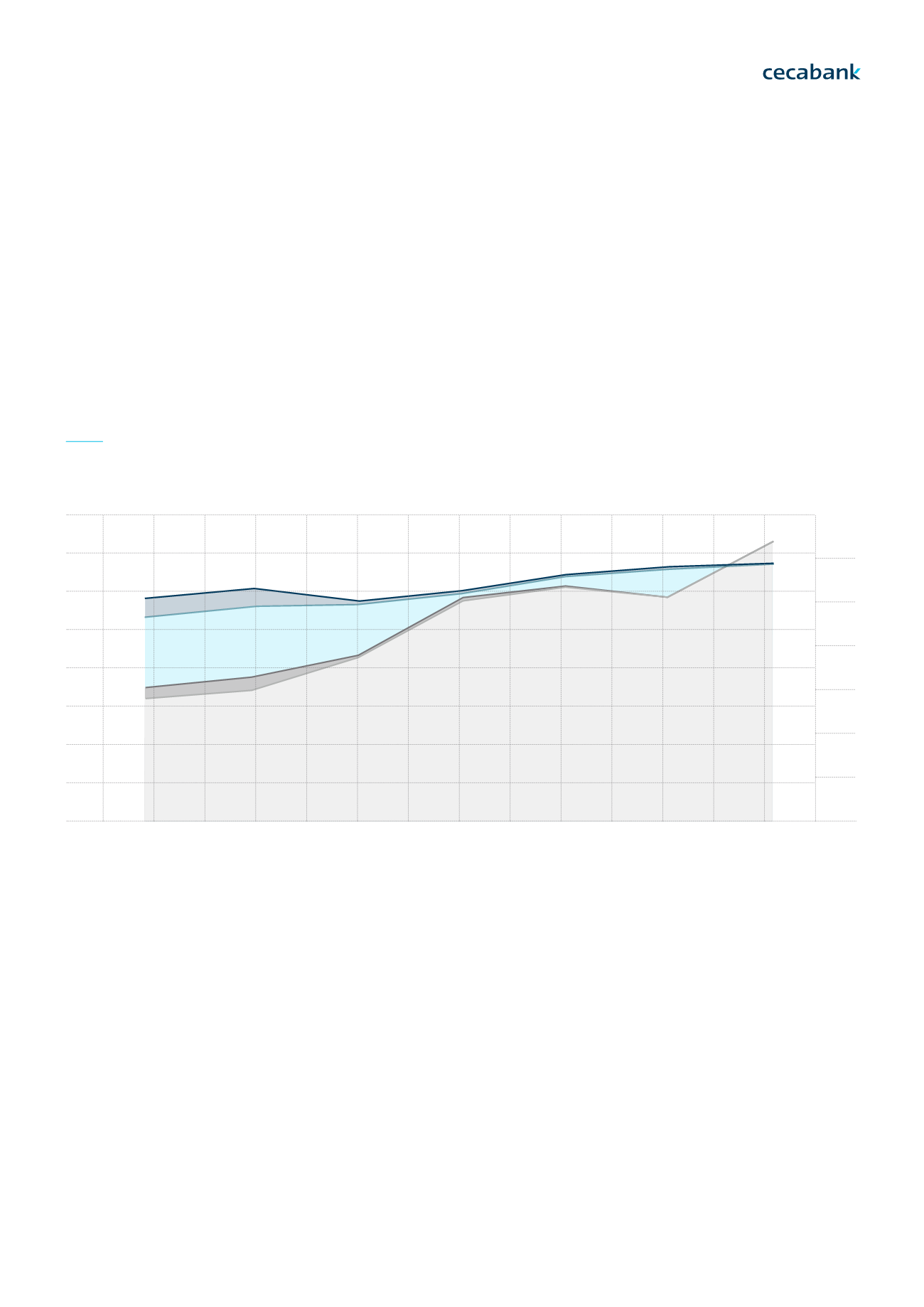

Robust capitalisation

At the close of the 2016 financial year Cecabank’s solvency ratio stood at

31.65% with 99.8% of capital being common equity Tier 1 capital, i.e. the

Tier 1 ratio stood at 31.58%.

A key factor for management is keeping a sound capital structure in terms

of quantity and quality. As a result (and as reflected in the graph) in recent

years, the Tier 1 capital base has been progressively strengthened through

the capitalisation of profit which, together with the maintenance of low risk

levels, has enabled a sustained improvement in capital ratios over time.

TIER 1 CAPITAL

TIER 1 CAPITAL

TIER 2 CAPITAL

TOTAL CAPITAL RATIO (RIGHT SCALE)

TIER 1 CAPITAL RATIO (RIGHT SCALE)

1,000

30%

20%

10%

0%

750

500

250

0

2010

2011

2012

2014

2016

2013

2015

Cecabank

2016 Annual Report

Page. 86

06 FINANCIAL INFORMATION

6.1

. Financial information | Results | Activity | Robust capitalisation | Ratings6.

2. Risk management | Structure and organisation | Assets and Liabilities Committee | The Compliance and Operational Risk Committee