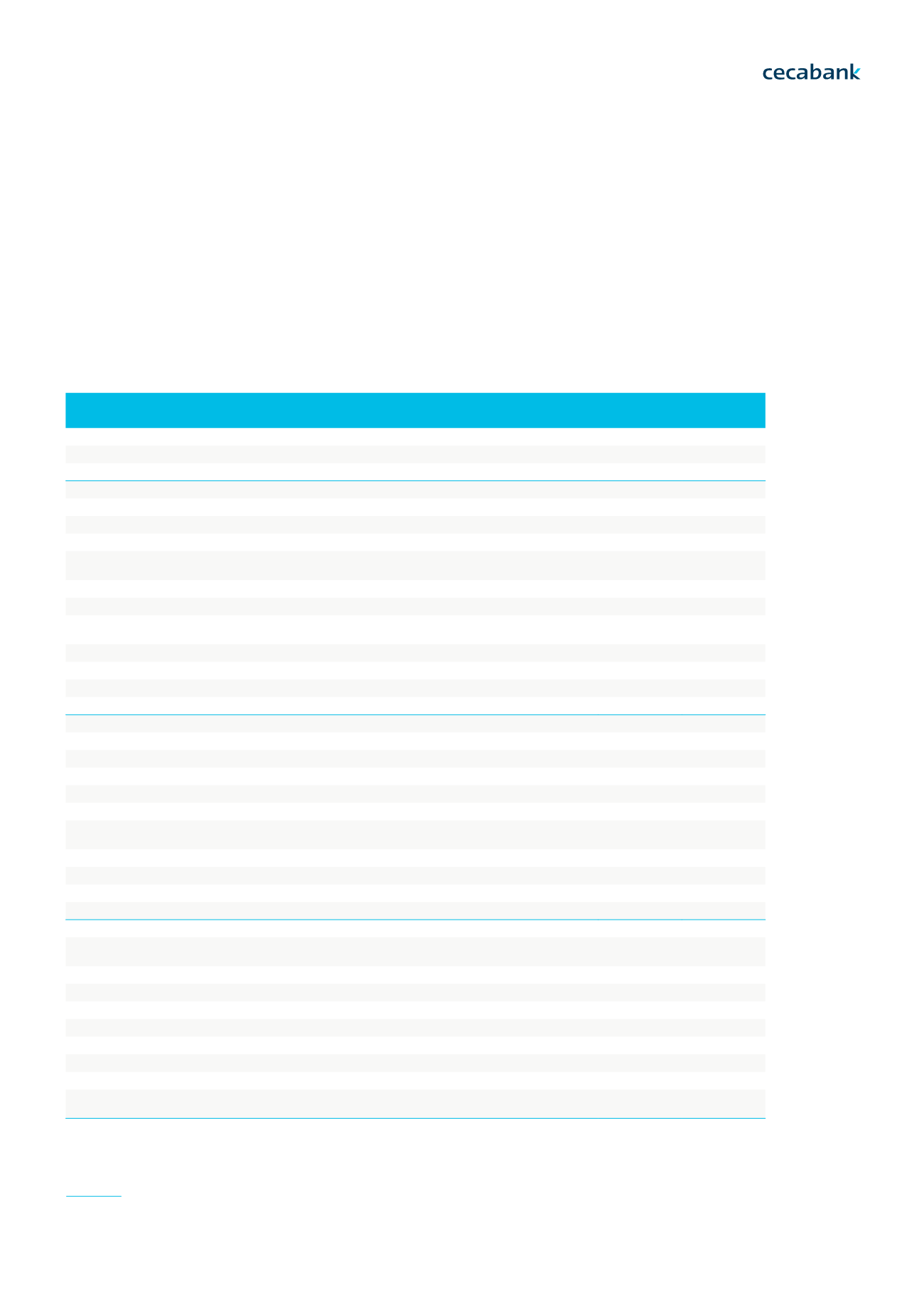

FINANCIAL INFORMATION

(*) Presented for comparative purposes only.

Notes 1 to 41 and Annexes I to IV, included in this report, are an integral part of profits

and losses for 2015.

Cecabank’s profit increased from 35 million euros in 2013 to 77

million euros in 2016, representing an increase of 130 per cent

over three years.

Results

Cecabank’s profit increased from 35 million euros in 2013 to 77 million euros in 2016, representing

an increase of 130 per cent over three years.

Income / (Expense)

2016

2015*

Interest income (Note 28)

111,106

67,414

Interest costs (Note 29)

(73,133)

(20,618)

Costs for social capital having the nature of a financial liability

-

-

A. NET INTEREST INCOME

37,973

46,796

Dividend income (Note 30

33,841

5,474

Commission income (Note 31)

134,269

128,130

Commissions costs (Note 32)

(15,405)

(16,251)

Profits or losses for deregistering assets or financial liabilities not measured

at fair value

through profit or loss, net (Note 33)

16,511

15,588

Profits or losses due to assets or financial liabilities held for trading, net (Note 33)

(38,902)

8,371

Profits or losses for assets or financial liabilities measured at fair value through

profit or loss, net (Note 33)

(290)

(1,215)

Gains or losses resulting from hedge accounting, net (Note 33)

(4,802)

(2,369)

Exchange differences, net

51,178

51,754

Other operating income (Note 34)

43,602

46,694

Other operating costs (Note 37)

(4,049)

(4,251)

B. GROSS INCOME

253,926

278,721

Administrative expenses

(115,182)

(115,585)

Staff costs (Note 35)

(51,689)

(52,773)

Other administrative expenses (Note 36)

(63,493)

(62,812)

Depreciation and amortisation (Note 39)

(55,588)

(49,688)

Provisions or reversal of provisions (Note 16)

3,236

(32,251)

Value impairment or reversal of value impairment of financial assets not

measured at fair value through profit or loss (Notes 22 and 38)

11,064

19,291

Financial assets valued at cost

-

-

Available-for-sale financial assets

(3,410)

(913)

Loans and receivables

14,474

20,204

Held-to-maturity investments

-

-

C. PROFIT FROM OPERATIONS

97,456

100,488

Impairment value or reversal of impairment value of investments in

subsidiaries, joint businesses, or associated companies (Note 11)

-

4,988

Impairment value or reversal of impairment value of non-financial assets

-

-

Tangible assets

-

-

Intangible assets

-

-

Other

-

-

Profits or losses on deregistering non-financial assets and liabilities, net (Note 12)

(12)

Of which: Investments in subsidiaries, joint businesses, and associate companies

-

-

Negative goodwill recognised in the income statement

-

-

Profits or losses from non-current assets or disposable groups of elements classified as held

for sale or inadmissible as discontinued activities (Note 10)

10,894

-

Cecabank

2016 Annual Report

Page. 82

06 FINANCIAL INFORMATION

6.1

. Financial information | Results | Activity | Robust capitalisation | Ratings6.

2. Risk management | Structure and organisation | Assets and Liabilities Committee | The Compliance and Operational Risk Committee