P.

50

2018 Pillar 3 Disclosures

Capital requirements for operational risk

Calculation of the Pillar 1 Regulatory Capital for operational risk is performed by applying the

percentages established in the standard method to the relevant revenue. The procedure includes

the following aspects:

•

Determination of relevant revenue.

•

Assignment of relevant revenue to business lines.

•

Application of weighting to the business lines.

•

Calculation of capital consumption

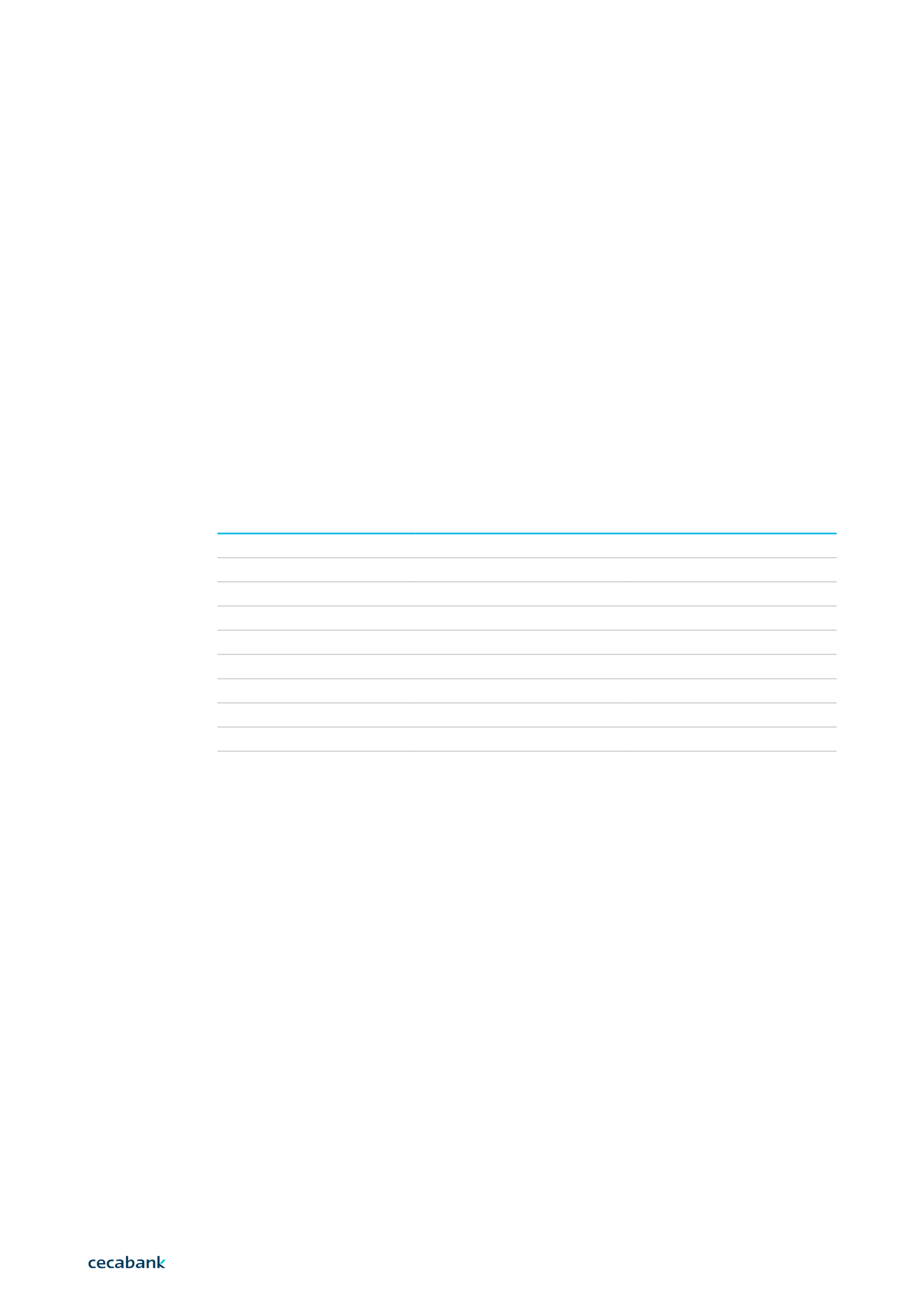

The following table indicates the capital consumptions at the close of 2018 for each line of

business:

Line of business

Weighting

Requirements

Trading and sales

18%

11,514

Commercial banking

15%

13,838

Retail banking

12%

46

Asset management

12%

0

Payment and settlement

18%

4,056

Agency services

15%

12,022

Retail brokerage

12%

0

Business funding

18%

65

Total

41,542

Thousands of euros.

Additionally, as mentioned in section 3.2.5, the bank applies a more stringent methodology than

that required by regulations, under the Pillar 2 framework.

7|