P.

56

2018 Pillar 3 Disclosures

Structural liquidity risk

This is the risk affecting or potentially affecting results or capital as a result of the bank being

incapable of meeting its payment obligations upon maturity, without incurring unacceptable losses.

This risk reflects the probability of incurring losses or having to give up new business or an

increase in current business through an inability to fulfil commitments upon maturity in a normal

manner, or being unable to fund additional needs at market costs. In order to mitigate this risk,

the liquidity situation is regularly monitored together with potential actions to be performed, and

measures are put in place in order to be able to re-establish the overall financial balance of the

bank in the event of a potential liquidity shortfall.

The measurement and analysis of this risk is performed by taking into consideration the following

aspects in accordance with the premises described below:

•

It is conducted on a daily basis.

•

Liquidity situations are analysed over different timeframes.

•

Compliance with the regulatory ratios is ensured.

•

They are accompanied by market indices and data affecting liquidity.

•

The analyses include all those positions which generate or could generate cash movements.

The bank maintains a high degree of stability in terms of liquidity sources, adequate capacity for

wholesale market calls and the availability of sellable assets. All of this results in a comfortable

liquidity situation.

A key factor that demonstrates Cecabank’s comfortable liquidity status is the reserve of the set of

highly liquid assets that it holds for the purpose of acting as a last resort in situations of maximum

market stress. A balanced liquidity structure is maintained due to the high amount of stable

deposits from clients and the investment in short-term assets with a high credit rating that are

also very liquid in nature.

At the end of 2018, the balance of this reserve of liquid assets to deal with potential liquidity

needs was €5,565 million, predominantly comprised of the balance of assets eligible for financing

operations with the European Central Bank (93%).

The following table shows the balance of liquid assets eligible for financing operations with

the European Central Bank and arranged according to the levels that affect the adjustments

(haircuts) applicable when being discounted. The values below already include these

adjustments:

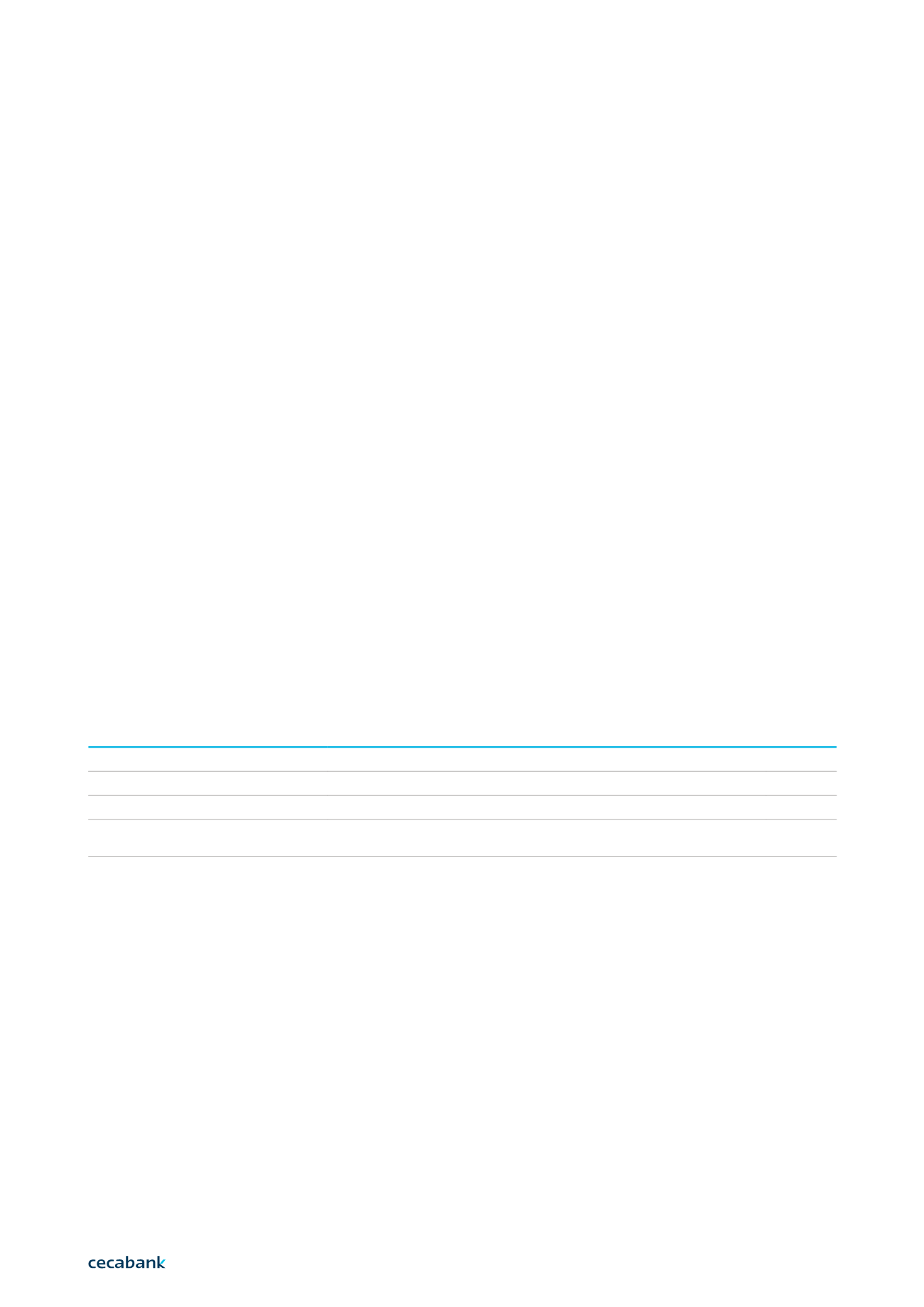

9|

Indicators

Indicator description

LCR (Liquidity Coverage Ratio)

Ratio defined in Section 1 of Article 412 of Regulation (EU) 575/2013.

228 %

Liquidity Ratio Vs Stable Financing

Overall percentage of liquidity originating from stable financing.

102 %

Short-Term Ratio

Ratio between collections and payments in a 1-month period.

301 %

NSFR (Net Stable Funding Ratio)

Proportion in which the stable funding of a bank covers its liquid assets. At

least 100% is required.

373 %