P.

57

2018 Pillar 3 Disclosures

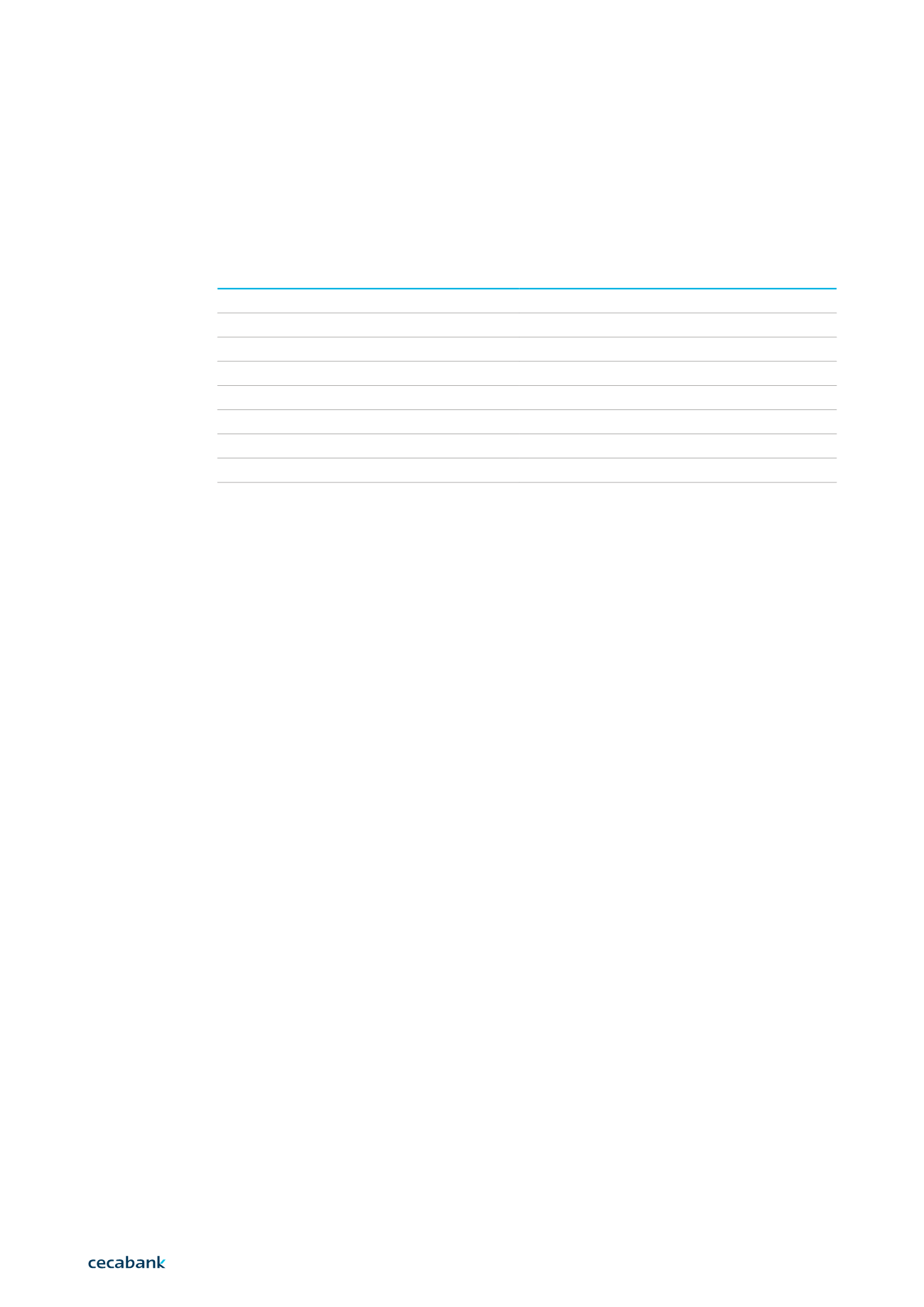

Structural liquidity risk

Liquidity categories by asset type

Central Bank + Cash-in-Hand + Other Cash

3,103,858

Level I

1,524,245

Level II

293,135

Level III

187,215

Level IV

48,752

Level V

0

Other liquid assets

408,562

TOTAL

5,565,766

Cecabank regularly conducts stress tests on the liquidity ratios, as indicated in section 7 of Annex

I. Among other factors, these stress scenarios take into account a prolonged closure of the capital

and interbank market, the activation of contingent lines and deposit flight. The result of these

exercises is that the bank has a sufficient buffer of liquid assets in place to withstand a situation

of prolonged stress.

9|