P.

60

2018 Pillar 3 Disclosures

Leverage

Another factor that demonstrates Cecabank’s level of solvency is the leverage ratio. As shown

below, the calculation made for December 2018 was 11.87%.

This ratio was established in Basel III as a not-sensitive-to-risk measure, aiming to limit the

possibility of excessively increasing companies’ balance sheets in relation to their available

capital. Its calculation is defined as the ratio between the eligible Tier 1 capital and a Non-risk

weighted measurement of exposure calculated in accordance with the definition established in

the EU Delegated Regulation 62/2015.

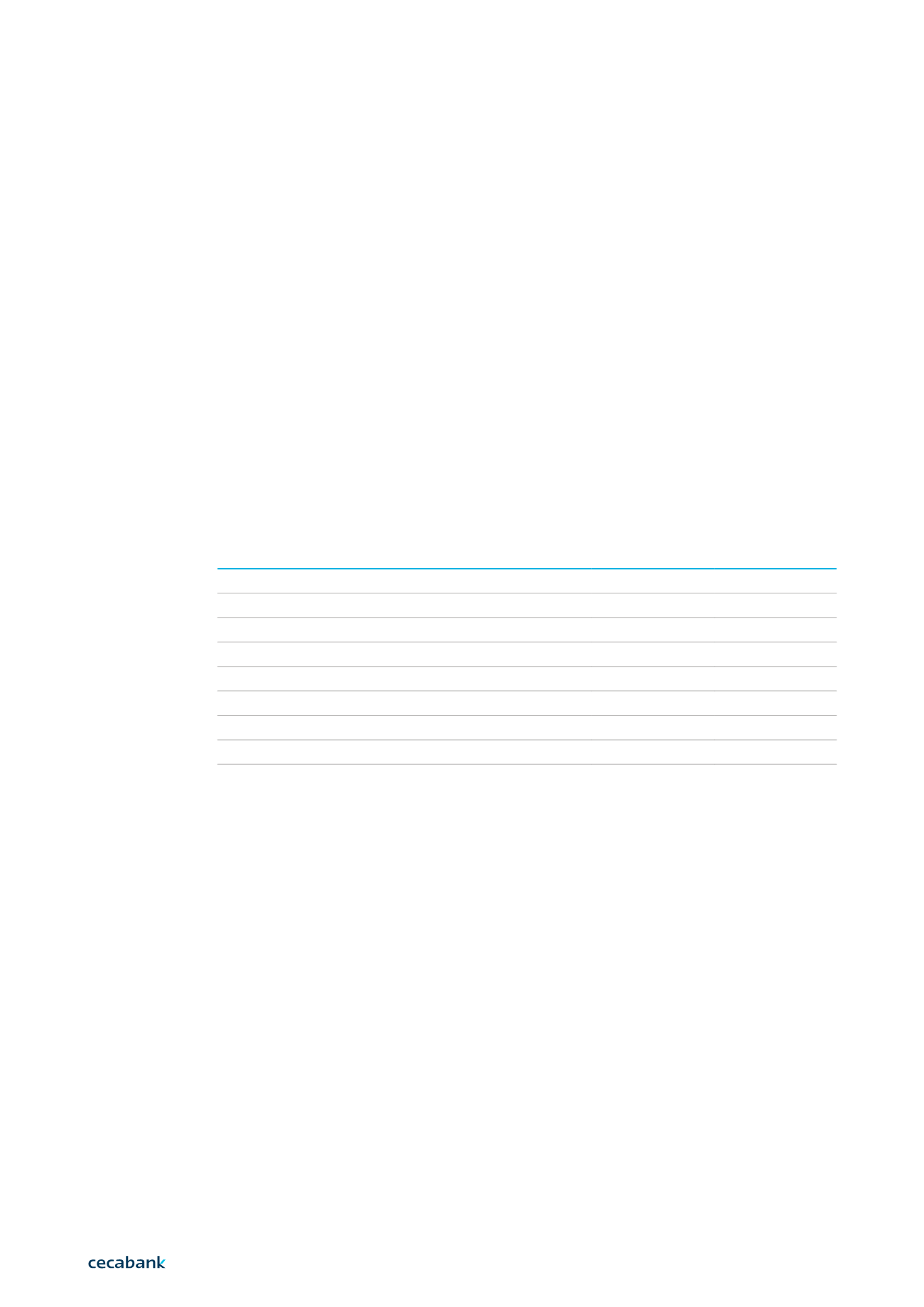

The following table shows the elements taken into consideration in the leverage ratio calculated

at 31 December 2018. Under the fully-loaded approach (coinciding with the phase-in calculation),

since the transition schedule envisaged for carrying out certain regulatory adjustments in the

calculation of the capital, and which the bank has been carrying out, was completed in December

2017. The bank is not applying the transitional provisions set forth in Regulation (EU) No.

2395/2017 to mitigate the impact on capital of the introduction of IFRS 9.

2018

2017

Tier I

791,312

743,692

Total Exposure

6,667,772

6,791,911

Derivatives

132,206

131,976

Securities lending and financing

75,546

175,709

Off-balance sheet items

95,144

289,910

Other assets

6,583,244

6,435,086

Adjustments

- 218,368

- 240,770

Leverage ratio

11.87%

10.95%

Thousands of euros.

Controlling the risk of leverage is incorporated within the standard monitoring of risk parameters.

There is a limit that is monitored based on the information received by the Risk Committee and

the Assets and Liabilities Committee in order to guarantee that the ratio comfortably exceeds the

level that is taken as the reference value (3%) and is currently pending its definitive incorporation

into the solvency regulations.

Monitoring is performed alongside the supervision of solvency levels and it includes an assessment

of both the bank’s exposure and available own funds.

10|