P.

54

2018 Pillar 3 Disclosures

Interest-rate risk in positions not included in the trading book

As mentioned above, the most representative indicators employed internally for management

identify the levels of structural interest-rate risk based on sensitivities to interest-rate

movements. The values of these indicators are set out below:

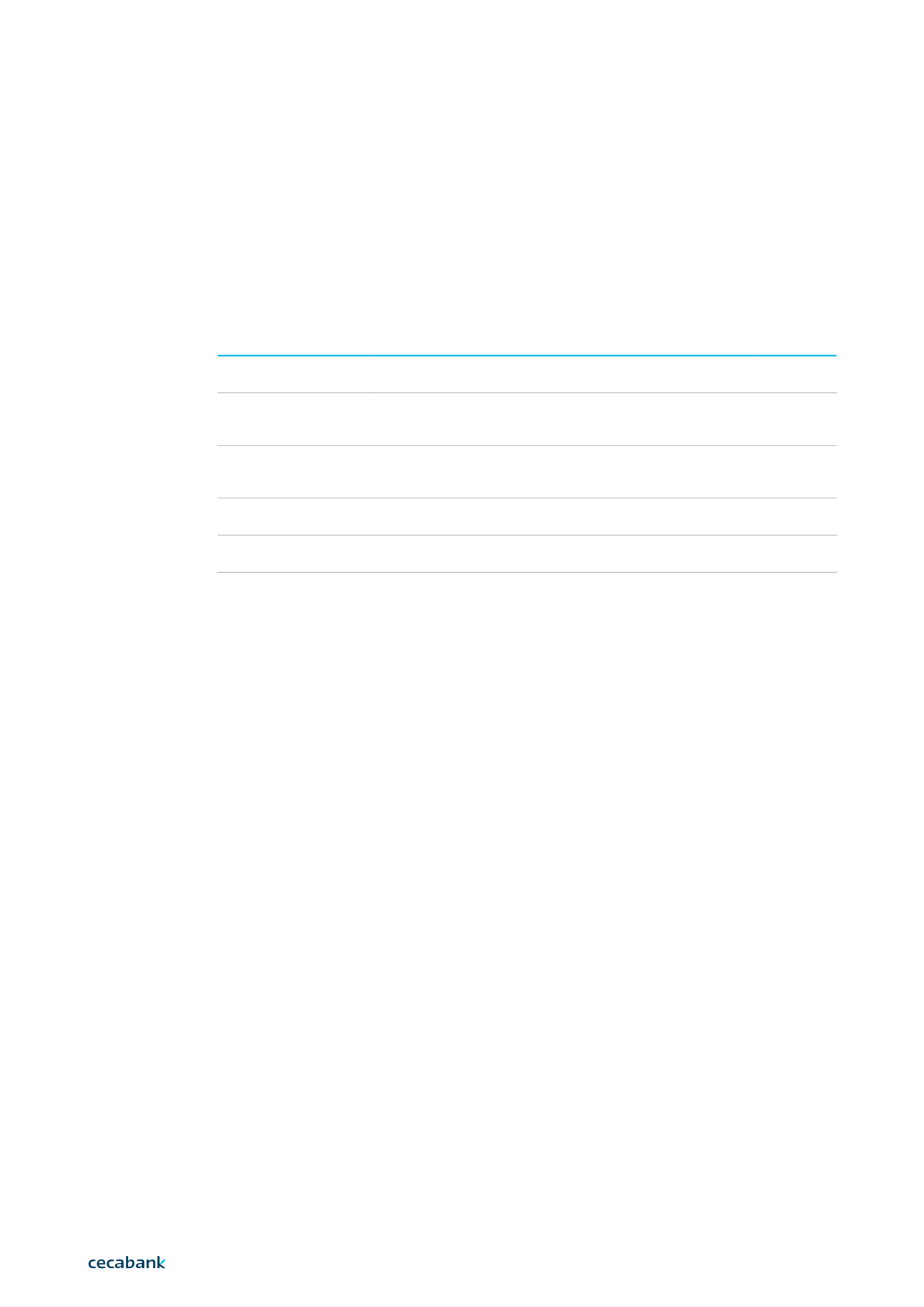

Indicator

Indicator description

Economic Value

The relationship between the economic value and the highest

quality eligible capital.

152.87%

Sensitivity to Economic

Value with respect to

Tier I and II

Percentage of eligible capital that would be represented by

the loss in Economic Value that would be caused by a sudden

variation of 200 b.p. on the interest-rate curves.

5.55%

Sensitivity to Economic

Value with respect to EVC

Percentage of economic value that would be represented

by the loss that would be caused by a sudden variation of 200 b.p.

on the interest-rate curves.

3.40%

Net Interest Margin

Sensitivity

Sensitivity of the one-year projections for the financial margin to

sudden variations of 200 b.p. on the interest-rate curves.

5.15%

VaR – Banking Book

Percentage of Tier 1 capital committed to the VaR of the Banking

Book.

0.54%

Datos medios del año.

8|