P.

53

2018 Pillar 3 Disclosures

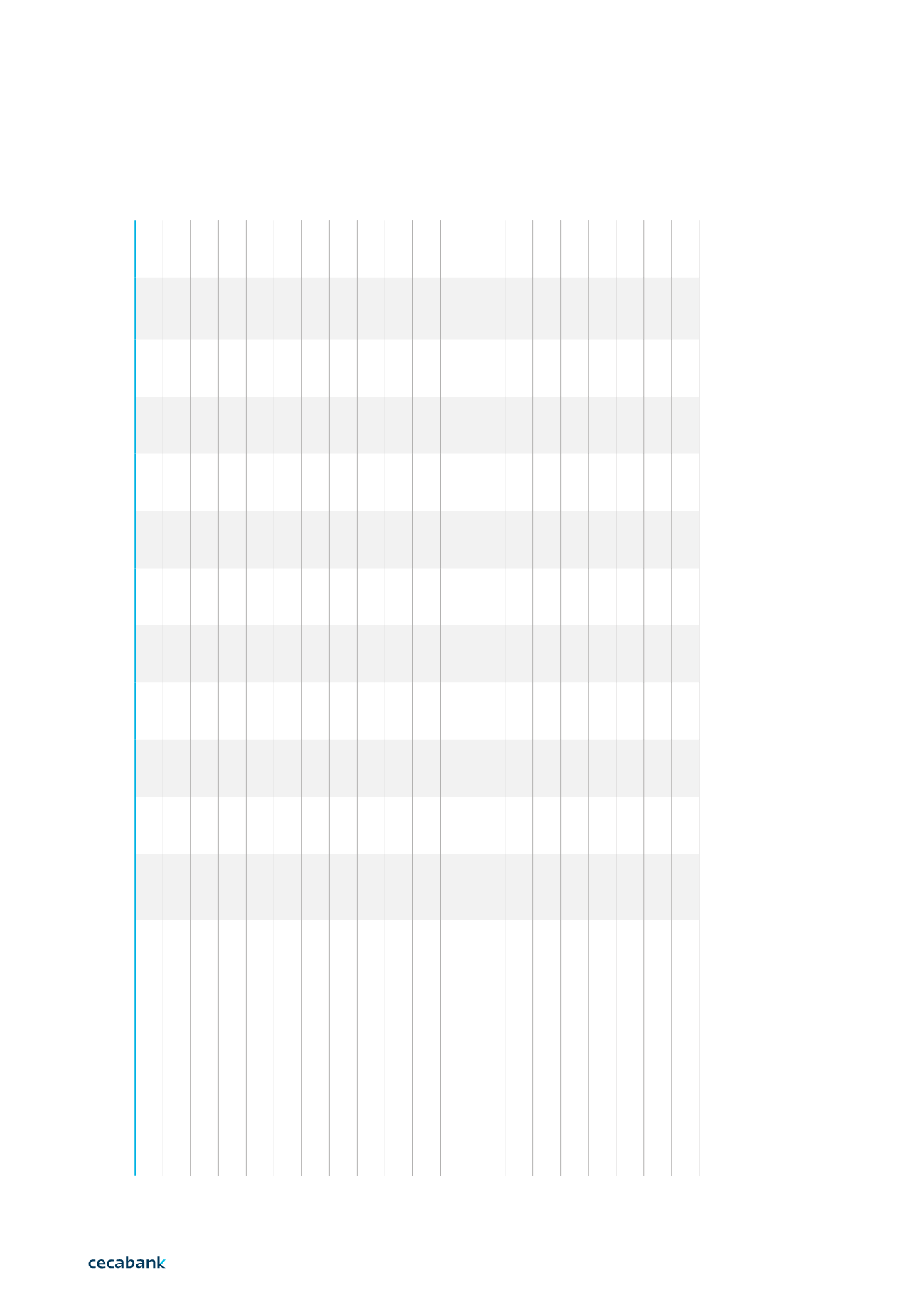

Interest-rate risk in positions not included in the trading book

0<=1M 1<=2M 2<=3M 3<=4M 4<=5M 5<=6M 6<=12M 1<=2Y 2<=5Y 5<=10Y 10<=20Y 20<=30Y

ASSETS

6,094,867 142,042 162,277 96,342 41,695 7,840 173,565 345,000 551,600 250,200 7,000 41,107

1. Cash and balances with central banks

3,122,687

2. Available-for-sale financial assets

1,036,784 136,434 126,101 64,270 25,250

171,140 345,000 521,600 200,200 7,000 1,356

2.1 Debt securities

1,036,784 136,434 126,101 64,270 25,250

171,140 345,000 521,600 200,200 7,000

2.2 Equity instruments

1,356

3. Loans and receivables

1,203,565

609 1,176 12,072 2,745

340 2,425

30,000 50,000

3.1 Debt securities

22,352

2,007

30,000 50,000

3.2 Customer credit

65,753

609

476

363

739

340 2,425

3.3 Credit institution deposits

1,115,459

700 11,709

4. Hedging derivatives

731,832 5,000 35,000 20,000 13,700 7,500

5. Investments

39,751

LIABILITIES

6,105,953 5,585 21,846 28,750 23,950 11,455 3,989 306,399 330,571 157,924 7,735

58

1.

Financial liabilities, amortised cost

and fair value with changes in P&L

1,509,733 5,585 3,846 4,418 1,750 1,455 3,989

99

190

324

235

58

1.1 Credit institution deposits

1,207,415 5,585 3,846 4,418 1,750 1,455 3,989

99

190

324

235

58

1.2 Temporary assignment of assets

302,318

1.3 Debts represent. by tradable securities

2. Customer deposits

4,596,220

63,281

3. Hedging derivatives

18,000 24,332 22,200 10,000

306,300 267,100 157,600 7,500

GAP

-11,086 136,457 140,431 67,593 17,745 -3,615 169,576 38,601 221,029 92,276

-735 41,050

ACCUMULATED GAP

-11,086 125,371 265,802 333,395 351,140 347,525 517,101 555,702 776,731 869,007 868,272 909,321

Thousands of euro.

8|