Page. 65

Cecabank

2015 Annual Report

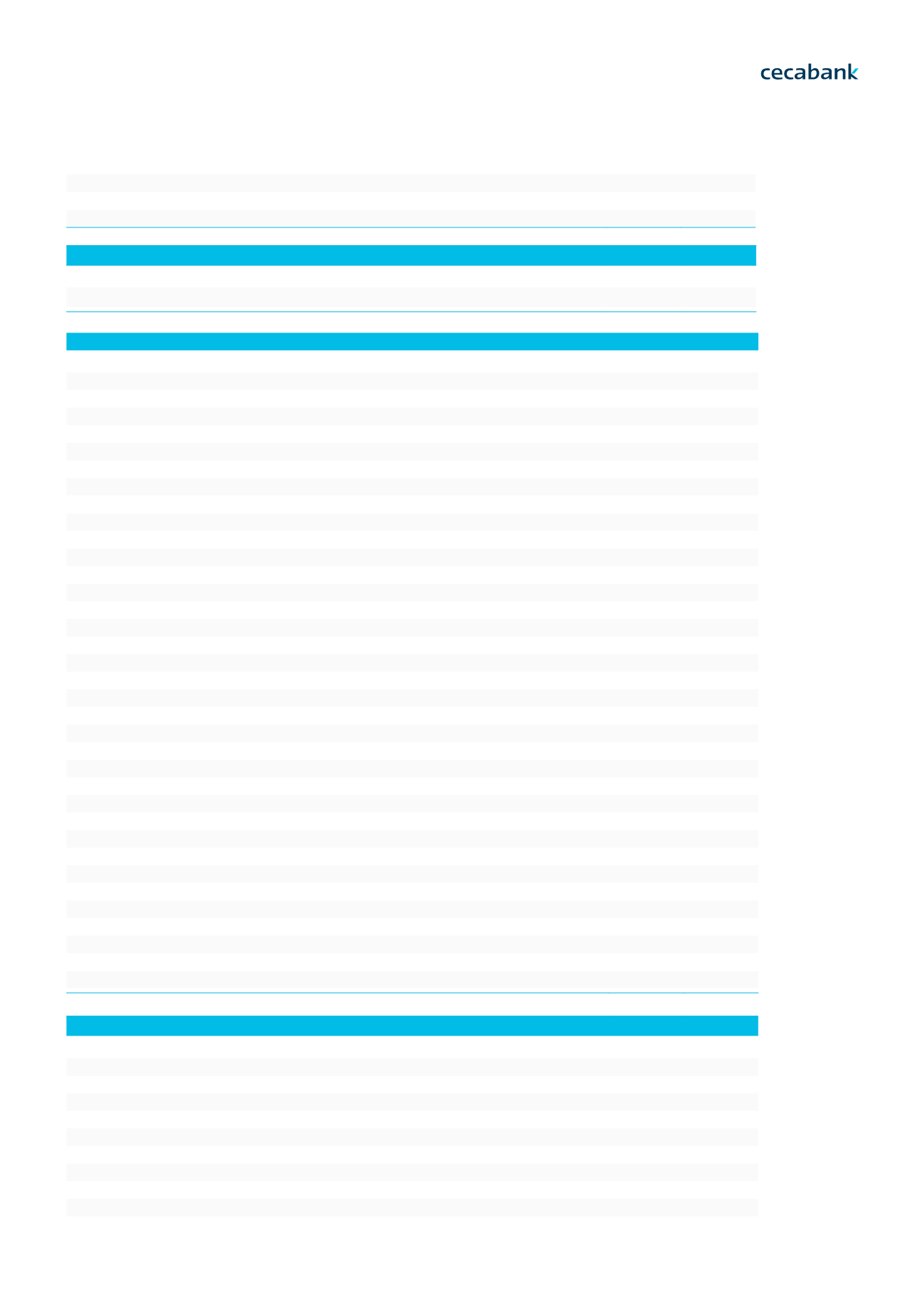

Memorandum accounts

Contingent liabilities (Note 27.1)

76.982 72.750

Contingent commitments (Note 27.3)

412.074 724.862

15.2 Deferred (Note 20)

127.637 123.890

16. Other assets (Note 14)

51.697 31.685

Total assets

11.982.646 10.862.998

Liabilities

2015

2014*

1. Financial liabilities held for trading (Note 6.1)

2.273.135 2.267.416

1.1 Deposits from central banks

-

-

1.2 Deposits from credit institutions

-

-

1.3 Customer deposits

-

-

1.4 Marketable debt securities

-

-

1.5 Trading derivatives

1.327.114 1.661.534

1.6 Short positions

946.021 605.882

1.7 Other financial liabilities

-

-

2. Other financial liabilities at fair value through profit or loss (Note 6.2)

1.109.908 1.365.643

2.1 Deposits from central banks

-

-

2.2 Deposits from credit institutions

675.885 692.386

2.3 Customer deposits

434.023 673.257

2.4 Marketable debt securities

-

-

2.5 Subordinated liabilities

-

-

2.6 Other financial liabilities

-

-

3. Financial liabilities at amortized cost (Note 15)

7.256.944 5.941.940

3.1 Deposits from central banks

-

-

3.2 Deposits from credit institutions

1.181.969 1.532.528

3.3 Customer deposits

5.829.642 3.922.701

3.4 Marketable debt securities

-

-

3.5 Subordinated liabilities

-

-

3.6 Other financial liabilities

245.333 486.711

4. Changes in the fair value of hedged items of portfolio hedges of interest rate

-

-

5. Hedging derivatives (Note 9)

4.418

6.073

6. Liabilities associated with non-current assets held for sale

-

-

8. Provisions

210.378 196.268

8.1 Provisions for pensions and similar obligations (Note 35)

91.094 84.498

8.2 Provisions for tax and other legal contingencies

-

-

8.3 Provisions for contingent risks and commitments (Note 16)

16

16

8.4 Other provisions (Note 16)

119.268 111.754

9. Tax liabilities (Note 20)

44.214 52.938

9.1 Current

4.376

3.077

9.2 Deferred

39.838 49.861

11. Other liabilities (Note 14)

112.714 101.007

12. Capital repayable on demand

-

-

Total liabilities

11.011.711 9.931.285

Equity

1. Own funds

901.434 837.894

1.1 Capital

112.257 112.257

1.1.1 Registered capital (Note 18)

112.257 112.257

1.1.2 Less: Uncalled capital

-

-

1.2 Share premium (Note 18)

615.493 615.493

1.3 Reserves (Note 19)

96.522 55.659

1.4 Other equity instruments

-

-

1.4.1 Equity component of compound financial instruments

-

-

1.4.2 Non-voting equity units and associated funds

-

-

1.4.3 Other equity instruments

-

-

1.5 Less: Treasury shares

-

-

1. Strategic lines | Economic and regulatory enviroment|

Building the future|

Business lines 2. Financial information|

Activity|

Income Statement|

Capital base|

Ratings 3. Business risk|

The risk function at Cecabank03 Our Business Model