Page. 64

03 Our Business Model

Cecabank

2015 Annual Report

1. Líneas estratég icas | Entorno económico y regulatorio | Construimos futur o | Líneas de Negocio

2. Información Financier a | Activid ad | Resultados | Ba se de capital | Ratings 3. Gestión del ri esgo | La función de Riesgos en Cecabank

Financial information

(*) Presented solely and exclusively for the purposes of comparison.

Notes 1 to 41 and Appendices I to IV of the accompanying Notes to the Financial

Statements form an integral part of the balance sheet as of 31 December 2015.

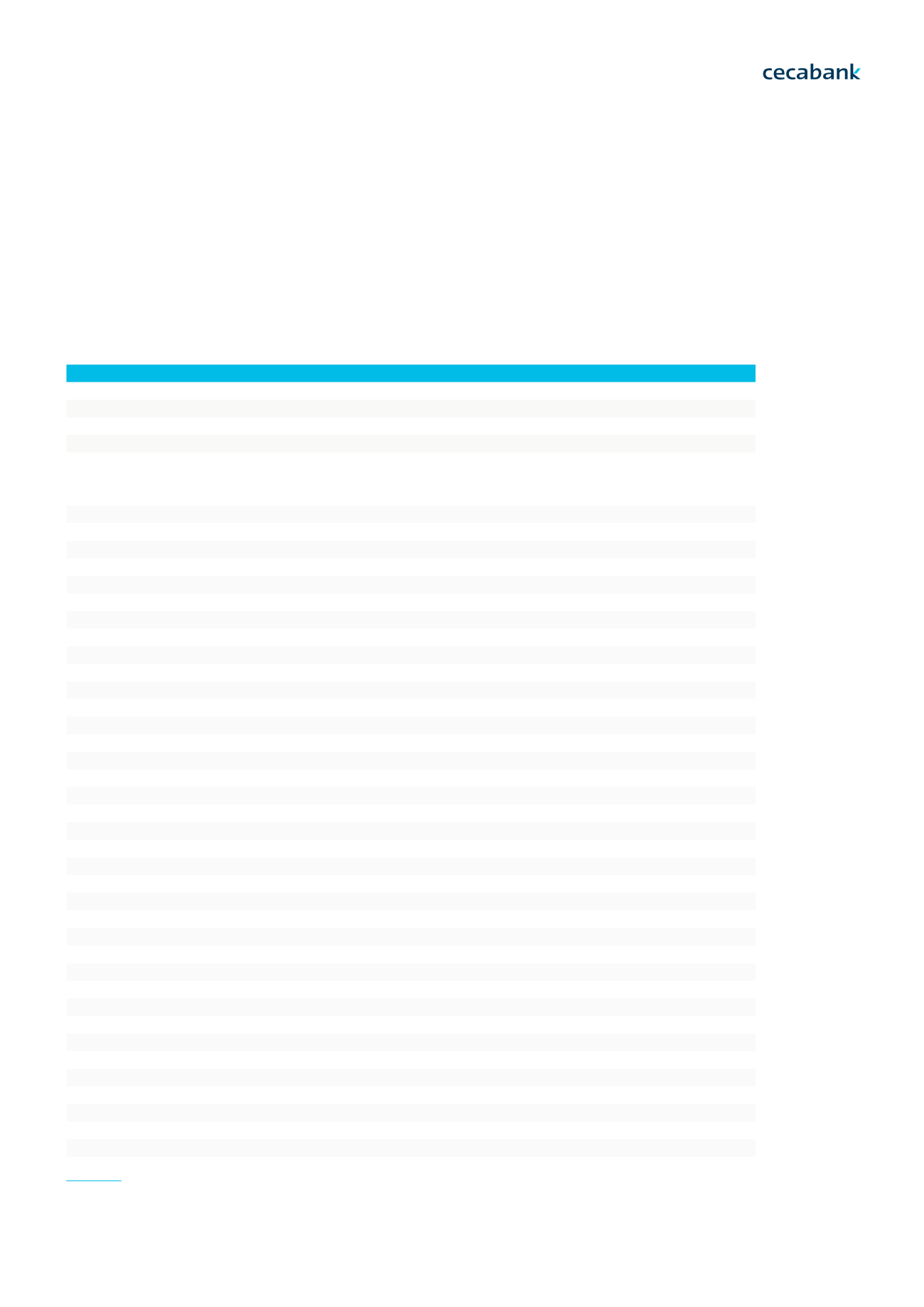

Activo

2015

2014*

1. Cash and balances at central banks (Note 5)

61.560

196.387

2. Financial assets held for trading (Note 6.1)

2.560.723 2.832.794

2.1 Loans and advances to credit institutions

-

-

2.2 Loans and advances to customers

-

-

2.3 Debt instruments

1.135.252 1.046.083

2.4 Equity instruments

63.160 67.867

2.5 Trading derivatives

1.362.311 1.718.844

Memorandum item: Loaned or advanced as collateral

309.418 219.885

3. Other financial assets at fair value through profit and loss (Note 6.2)

2.786.463 3.624.938

3.1 Loans and advances to credit institutions

2.698.393 2.748.641

3.2 Loans and advances to customers

29.954 876.297

3.3 Debt instruments

-

-

3.4 Equity instruments

58.116

-

Memorandum item: Loaned or advanced as collateral

332.398 833.752

4. Available-for-sale financial assets (Note 7)

4.202.012 2.585.344

4.1 Debt instruments

4.112.932 2.523.149

4.2 Equity instruments

89.080 62.195

Memorandum item: Loaned or advanced as collateral

716.426 296.605

5. Loans and receivables (Note 8)

2.035.666 1.355.848

5.1 Loans and advances to credit institutions

1.226.997 923.917

5.2 Loans and advances to customers

767.445 389.102

5.3 Debt instruments

41.224 42.829

Memorandum item: Loaned or advanced as collateral

38.673

-

6. Held-to-maturity investments

-

-

Memorandum item: Loaned or advanced as collateral

-

-

7. Changes in the fair value of hedged items of portfolio hedges of interest rate risk

-

-

8. Hedging derivatives (Note 9)

222

19

9. Non-current assets held for sale (Note 10)

18.487 18.504

10. Investments (Note 11)

416

867

10.1 Associates

-

312

10.2 Jointly controlled entities

-

451

10.3 Group entities

416

104

11.Insurance contracts linked to pensions

-

-

13. Tangible assets (Note 12)

53.363 53.232

Property, plant and equipment

52.375 52.208

For own use

52.375 52.208

Other assets leased out under operating leases

-

-

Assigned to welfare projects

-

-

Investment properties

988

1.024

Memorandum item: Acquired under a financial lease

-

-

14. Intangible assets

83.865 39.264

14.1 Goodwill

-

-

14.2 Otro activo intangible (Nota 13)

83.865 39.264

15. Tax assets

128.172 124.116

15.1 Current

535

226

Activity

Cecabank, S.A. Balance Sheet as of 31 December 2015 and 2014 (thousands of euros)

At the end of 2015, Cecabank had 11,982 million euros

in assets and a CETI ratio of 25.33 per cent