Page. 67

Cecabank

2015 Annual Report

875.000

750.000

25

675.000

500.000

20

375.000

250.000

15

125.000

0

10

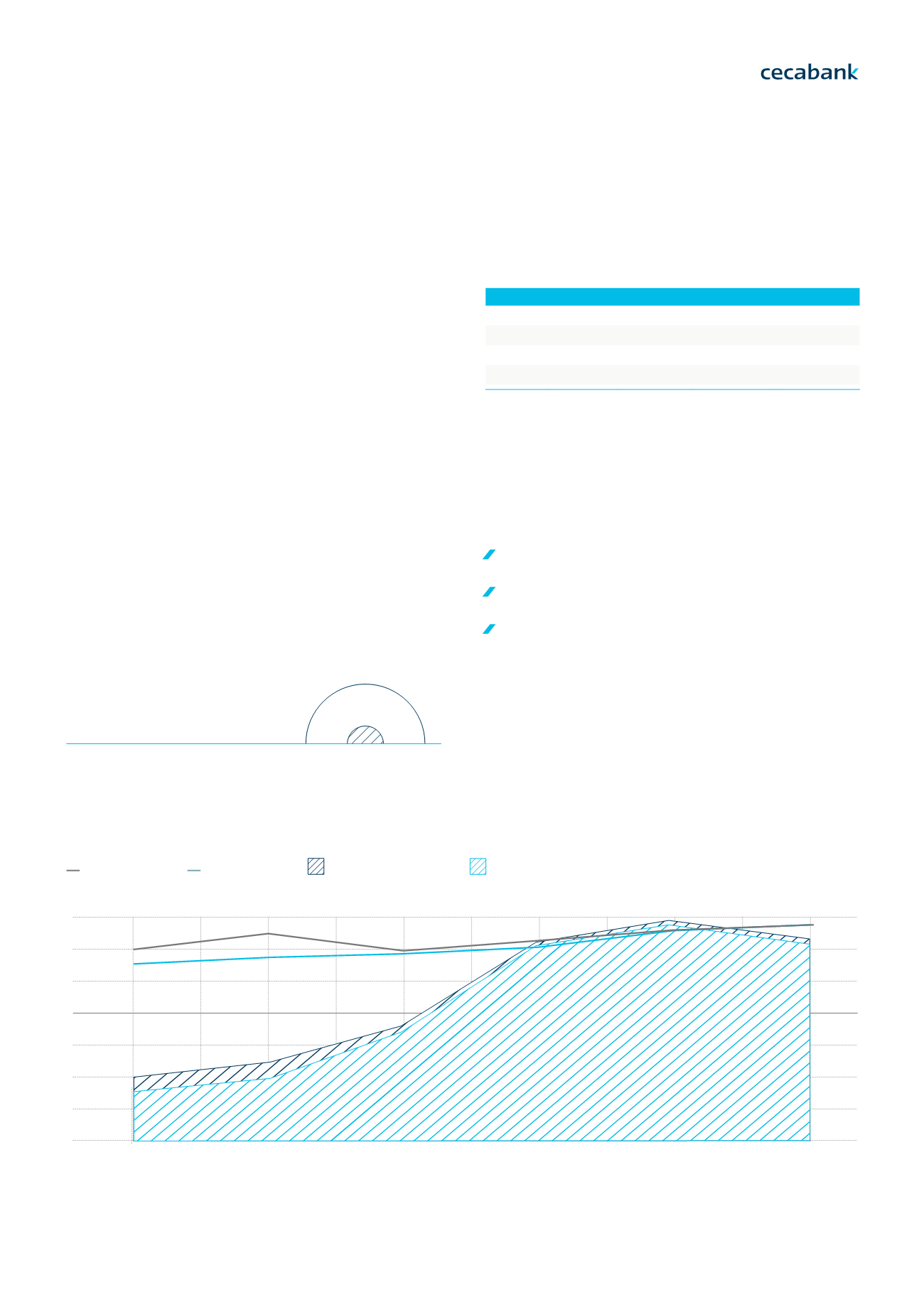

Capital base

At the end of financial year 2015 Cecabank’s solvency

ratiowas of 25.33%, with99.4%of capital being common

Tier 1 capital, i.e. the Tier 1 ratio stood at 25.18%.

A key element in management was and is to maintain a

sound capital structure in terms of quantity and quality.

Cecabank’s Board of Directors established a minimum

capital ratio of 14%. This ratio is established in terms

of Common Equity Tier 1 (CET1). In addition, the Risk

Tolerance Framework establishes a wide margin for this

ratio which the entity must use for operating in normal

situations. Both levels are currently easily surpassed.

Cecabank’s comfortable solvency position enables it to

cover present and future capital requirements and the

risks not considered in Pillar 1. Moreover, these ratios

are lower than would be obtained by applying the

solvency regulations without transitory clauses (fully

loaded Basel III).

Ratings

As of 31 December 2015, the ratings Cecabank had been

given by the international rating agencies, Fitch Ratings,

Moody’s y Standard & Poor’s, are as follows:

Cecabank

Agency Short term Long term Outlook

Date

Moody´s

P-2

Baa2

stable 17/06/2015

Fitch

F-2

BBB-

stable 04/11/2015

S&P

A-2

BBB

stable 02/02/2016

The strategic reorientation and the success of its

implementation were key factors in the upgrading of the

different agencies’ credit ratings and now all three ratings

are Investment Grade. In general, when rating our bank,

the agencies highlighted the success of the following as

positive elements:

The liquidity position

The strategic reorientation of the bank

The conservative risk profile

2010

2011

2012

2013

2014

2015

Tier 1 capital

CET 1

25.33

%

Eurozone average: : (September 2015)

13.05

%

Total capital ratio

Tier 1 capital ratio

Tier 2 capital

Tier 1 capital

1. Strategic lines | Economic and regulatory enviroment | Building the future | Business lines 2. Financial information | Activity |I

ncome Statement | Capital base | Ratings 3. Business risk | The risk function at Cecabank03 Our Business Model