Monetary policies

In

Europe,

as the chart shows, the effects of ultra-expansive monetary policy

are revealed in the interest rate curves, both in Germany and Spain, which

continue to flatten out (both short term and long term rates). There are three

potential scenarios for the future:

1.

That there is an increase (not expected) in inflation, starting a phase of

abrupt monetary restriction, which would have the potential to bring in-

tense financial instability, and high and volatile interest rates.

2.

That loose monetary policy continues, a scenario in which advanced

economies would follow the Japanese model and low interest rates would

remain constant.

3.

That monetary normality is gradually restored, which would lead to a

slow and ordered return to normal GDP and inflation growth and the

increase in rates would be gradual and modest.

In the

United States

, Donald Trump’s plans have triggered inflation expecta-

tions and, by extension, interest rate increases. Investors expect the Fed to

increase interest rates three times in 2017.

Central banks’

monetary

policies

have also had a

serious impact in 2016.

200

180

160

140

120

100

80

60

7,500

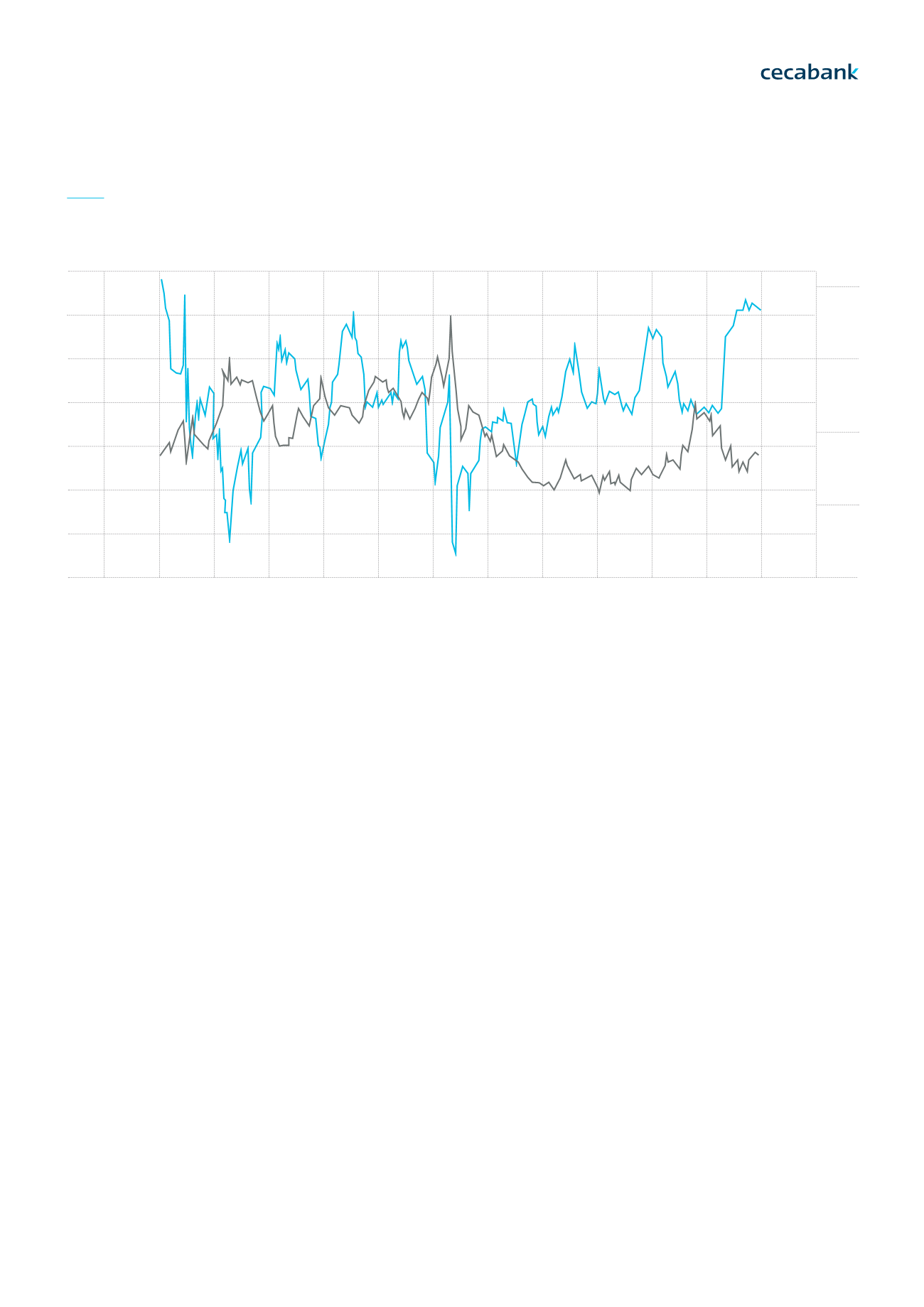

SPANISH RISK PREMIUM VS IBEX

Source: datosmacro

Spanish risk premium

IBEX

(right scale)

1

2016

2

2016

6

2016

3

2016

7

2016

10

2016

4

2016

8

2016

11

2016

5

2016

9

2016

12

2016

9,500

9,000

8,000

8,500

Cecabank

2016 Annual Report

Page 57

05 OUR BUSINESS MODEL

5.1

. Economic and regulatory context | Economic framework and state of the markets | Agenda | Overview 2013-20165.2

. Lines of Business | Securities Services | Treasury Management | Banking Services