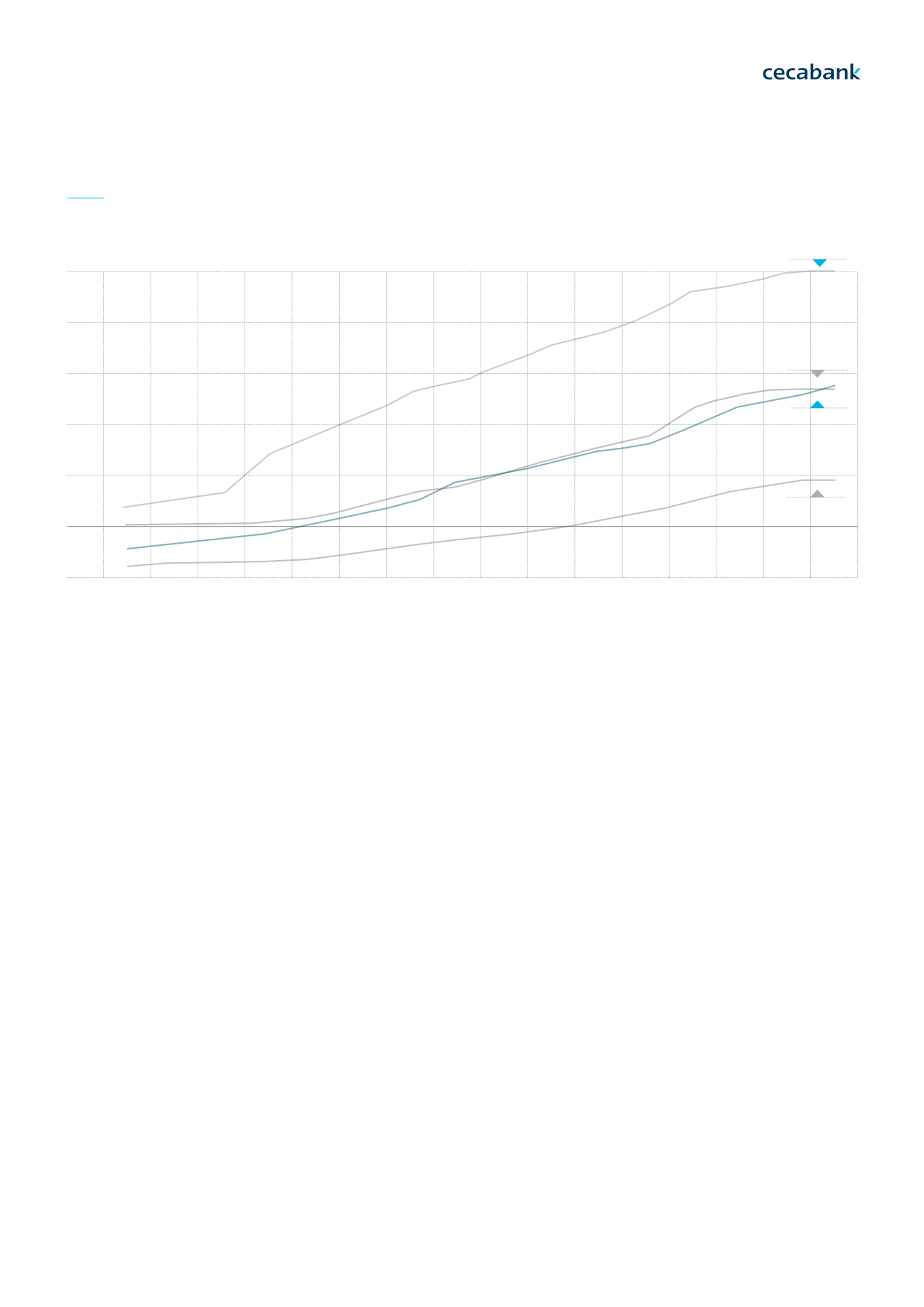

EVOLUTION OF INTEREST RATE CURVES FOR GERMAN AND SPANISH PUBLIC DEBT (2013-2016)

Source:

datosmacro.comIn short, uncertainty about the repercussions of significant political events in

2016 such as Brexit and Trump has yet to clear, and there are already other

political happenings on the European horizon, which we will undoubtedly

focus our attention on in 2017 (elections in Holland, France, and Germany).

The central banks will continue to look to national and supranational political

authorities and continue to ask for their full involvement.

Banking business developments

In this complex setting, the amount of credit lent to the private sector conti-

nued to contract to December, placing the annual variation rate across the

financial system as a whole at -2.8 per cent, compared with -4.3 per cent

in the same period the previous year. The new funding of the retail sector

continued to grow over the whole year, but at a slower rate than registered

in 2015 and with variation according to different sectors: credit to SMEs and

households grew at a modest rate whilst consumer credit maintained strong

growth (29 per cent). Furthermore, credit granted to large companies redu-

ced by 33%, due to these companies having the more attractive option to

fund themselves with negotiable debt securities, to the detriment of banking

credit, in a context of a decrease in the relative cost of fixed income issues

which have been boosted by the expansion of the ECB share buying program-

me for corporate debt instruments.

Since the start of the year retail deposits have registered an upward trend,

reaching a 3 per cent year-on-year increase in December. Despite low inte-

rest rates for deposits, the reduced yield of alternative products and major vo-

latility on the stock markets have made this recovery possible, concentrated

on the increase in demand deposits.

GERMANY

SPAIN

5.0

4.0

3.0

2.0

1.0

0.0

-1.0

3 month 6 month 1 year 2 year 3 year 4 year 5 year 6 year 7 year 8 year 9 year 10 year 15 year 20 year 25 year 30 year

GERM.

Nov 2016

GERM.

Nov 2013

SPAIN

Nov 2016

SPAIN

Nov 2013

Since the start

of the year retail

deposits have

registered an

upward trend.

Cecabank

2016 Annual Report

Page 58

05 OUR BUSINESS MODEL

5.

1. Economic and regulatory contex t | Economic framework and state of the markets | Agenda | Overview 2013-20165.

2. Lines of Business | Securities Services | Treasury Management | Banking Services