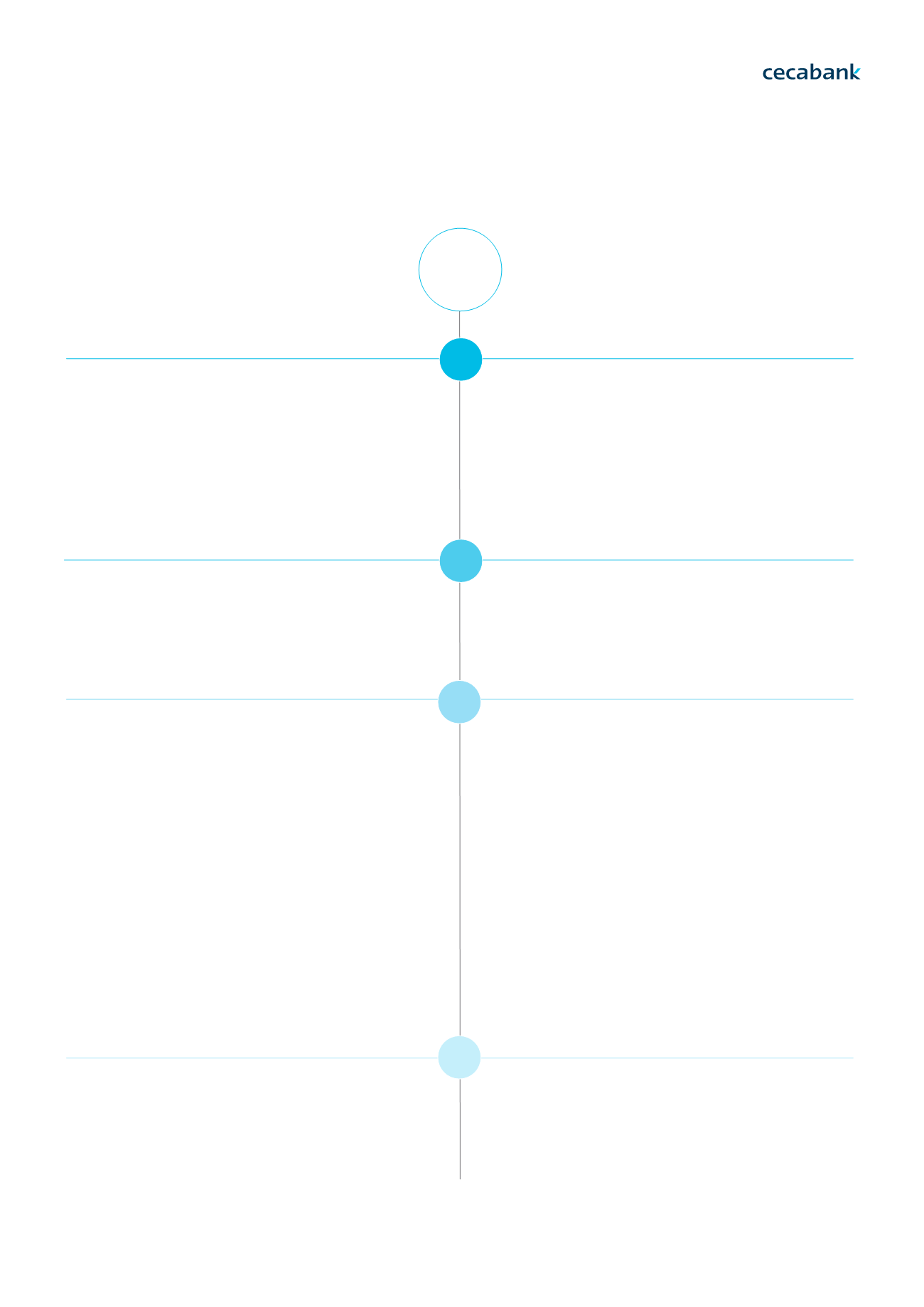

Regulatory agenda

Main events in 2016

Bank of Spain

Circular 2/2016,

of 2 February, to credit institu-

tions on supervision and solvency, completing the adjustment

of Spanish legal order to Directive 2013/36/EU and EU Regu-

lation no. 575/2013.

Bank of Spain

Circular 3/2016,

of 21 March, to ATM holding

companies and companies issuing cards or other payment

instruments on information on fees for withdrawing cash

from ATMs.

Bank of Spain

Circular 4/2016,

of 27 April, modifying the 22

December Circular, to credit institutions, on public and confi-

dential financial reporting standards and financial statement

formats, and Circular 1/2013 of 24 May, on the Risk Informa-

tion Centre.

Bank of Spain

Circular 5/2016,

of 27 May, on the method for

calculating associated members’ contributions to the Credit

Institutions’ Deposit Guarantee Fund to ensure that contribu-

tions are proportional to risk profile.

Bank of Spain

Circular 6/2016,

of 30 June, to credit institu-

tions and finance companies, determining the content and the

format of the document ‘Información Financiera-PYME’ and

specifying the method used for risk ratings established in Act

5/2015 of 27 April, for promoting business funding.

Circular 4/2016,

of 29 June, of the CNMV (National Securi-

ties Market Commission), on the functions of depositaries for

collective investment institutions and entities regulated by

Act 22/2014 of 12 November, regulating venture capital en-

tities, other closed-ended collective investment entities and

closed-ended collective investment management companies,

modifying Act 35/2003 of 4 November, for collective invest-

ment institutions.

Bank of Spain

Circular 7/2016,

of 29 November, developing ac-

counting requirements for banking foundations, Circular 4/2004,

of 22 December, to credit institutions, on public and confidential

financial reporting standards and financial statement.

Delegated regulation (EU) 2016/438,

from the Commission

on 17 December 2015, completing EC Directive 2009/65

from the European Parliament and Council regarding the obli-

gations of depositories.

Regulation (EU) 2016/445

of the European Central Bank, of

14 March 2016, on the exercise of options and rights offered

by the law of the Union ECB/2016/4)..

Regulation (EU) 2016/679

of the European Parliament and

Council of 27 April 2016 regarding the protection of indivi-

duals in terms of personal data and the free circulation of these

details, thus repealing Directive 95/46/EC (General ruling for

data protection).

Regulation (EU) 2016/867

of the European Central Bank, of

18 May 2016, on the collection of granular credit and credit

risk data (Anacredit).

Reglamento (UE) 2016/1011

del Parlamento Europeo y del

Consejo de 8 de junio de 2016 sobre los índices utilizados

como referencia en los instrumentos financieros y en los con-

tratos financieros o para medir la rentabilidad de los fondos de

inversión, y por el que se modifican las Directivas 2008/48/CE

y 2014/17/UE y el Reglamento (UE) nº 596/2014

Regulation (EU) 2016/2067

of the Commission, of 22 No-

vember 2016, modifying Regulation (EC) no. 1126/2008,

adopting certain International Accounting Standards in accor-

dance with the Regulation (EC) no. 1606/2002 of the Euro-

pean Parliament and Council, relating to International Finan-

cial Information Standards 9. formats, and Circular 1/2013, of

24 May, on Spain’s Risk Information Centre

National

International

Q4

Q3

Q2

Q1

2016

Cecabank

2016 Annual Report

Page 60

05 OUR BUSINESS MODEL

5.

1. Economic and regulatory contex t | Economic framework and state of the markets | Agenda | Overview 2013-20165.

2. Lines of Business | Securities Services | Treasury Management | Banking Services