3. Diversification of income

As a consequence of

the implementation

of the 2013-2016

Strategic Plan, Cecabank

has achieved a more

balanced mix of products

and greater recurrence,

with less dependence on

the financial margin

and greater input in fees,

which now account for

61% of income.

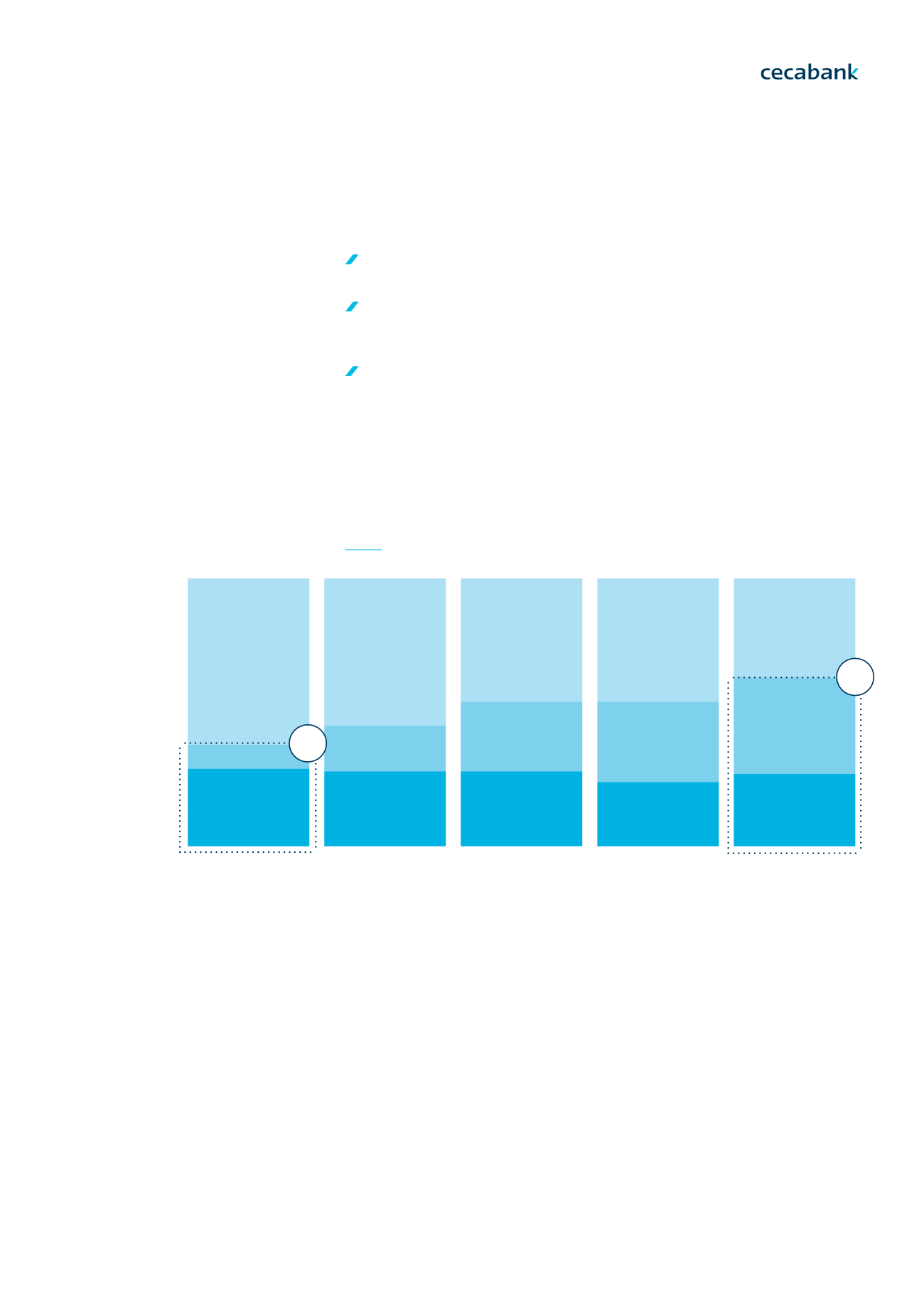

The gross income for the three lines of business is as follows:

Treasury Management’s contribution to the gross income has reduced

from 62 per cent in 2012 to 39 per cent at present.

A commitment to invest in the Securities Services service has meant this

line has gone from representing 9 per cent in 2012 to 35 per cent of gross

income in 2016.

Income from Banking Services has remained at 26 per cent over the four

year period.

2012

2013

2014

2015

2016

Securities

Services

Treasury

Management

Banking

Services

29%

28%

28%

25%

26%

9%

17%

26%

30%

35%

62%

55%

46%

45%

39%

61

%

38

%

DISTRIBUTION OF TURNOVER

BY LINE OF BUSINESS

% on Gross Income

Page. 17

Cecabank

2016 Annual Report

1.1

. Strategic Plan: We reach the end of a cycle.1.2

. Main achievements | Improvement of key ratios | Consolidation of the business model | Diversification of income | Diversification of client base | New corporate culture1.3

. 2017-2020 Strategic Plan | Structure | Objectives01 2013-2016 STRATEGIC PLAN