SOLVENCIA

31.87%

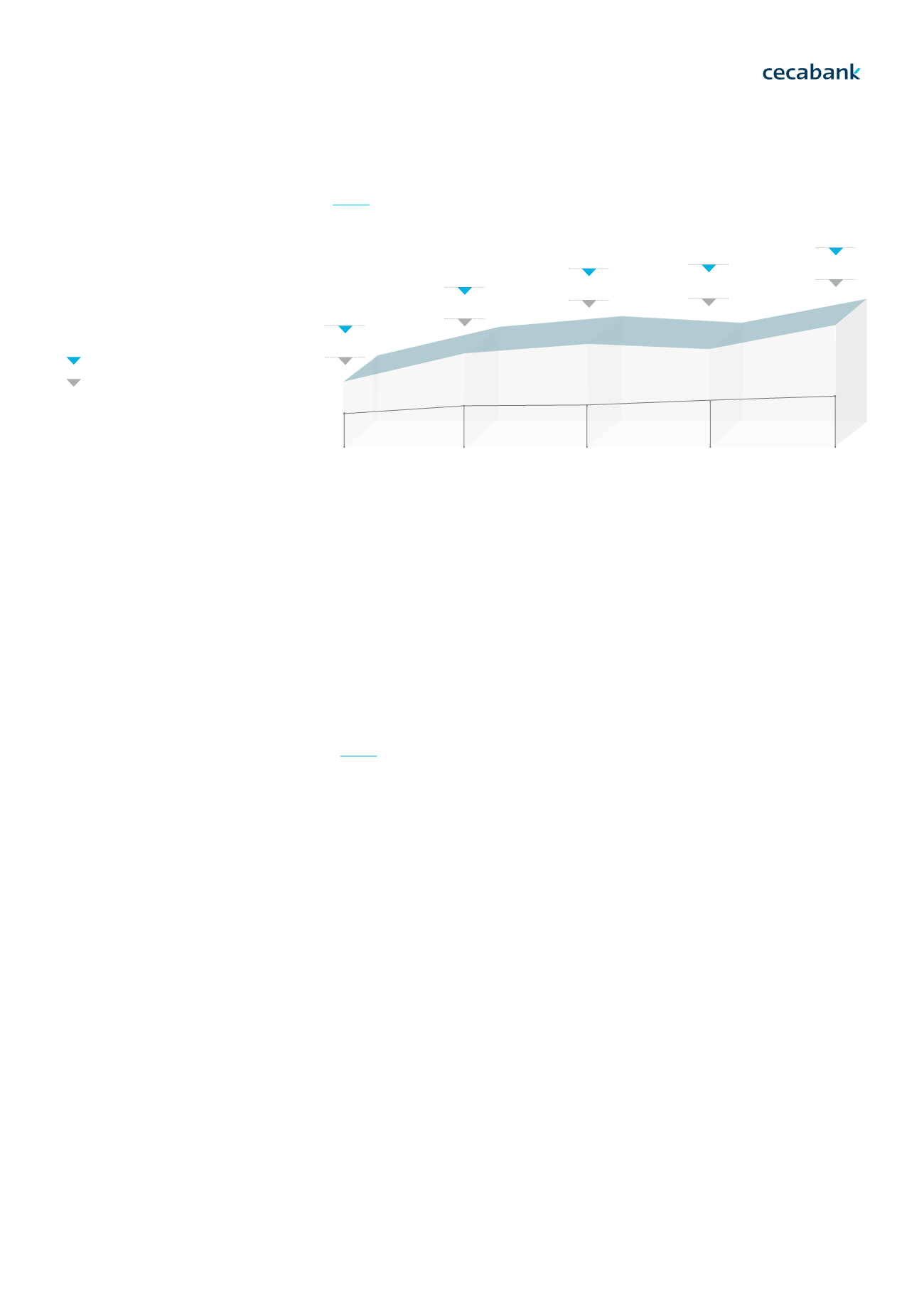

In terms of solvency, in 2012 Cecabank had a solvency level of 18.4 per cent

in 2012, which has continued to strengthen in the four years under the Plan,

with Common Equity Tier 1 capital (CET1) standing at 31.9 per cent in De-

cember 2016.

This represents an increase of 13.5 percentage points in comparison with the

levels registered at the start of the Strategic Plan, and is significantly higher

than the financial sector average (12.9 per cent) but similar to companies in

similar businesses.

2012

2013

2014

2015

2016

RATING

2012

2013

2016

Ba1

Ba3

Baa2

Moody’s

BBB-

BBB-

BBB-

Fitch

BB+

BB+

BBB

S&P

10.00%*

11.90%*

11.82%

12.66%

18.36%

24.71%

26.53%

25.33%

12.96%**

31.87%

The development

of credit ratings

has been particularly

favourable.

* Up to 2013 it is the basic

solvency rate, calculated by

the Bank of Spain

** 3Q16

Cecabank

Spanish financial system

Page. 14

Cecabank

2016 Annual Report

1.1

. Strategic Plan: We reach the end of a cycle.1.

2. Main achievements | Improvement of key ratios | Consolidation of the business model | Diversification of income |Diversification of client base | New corporate culture

1.

3. 2017-2020 Strategic Plan | Structure | Objectives01 2013-2016 STRATEGIC PLAN