5. New corporate culture

4. Diversification of client base

In accordance with the Plan, initiatives working towards adapting the orga-

nisation and management of change brought about by the transformation of

the company’s business model have been put into place.

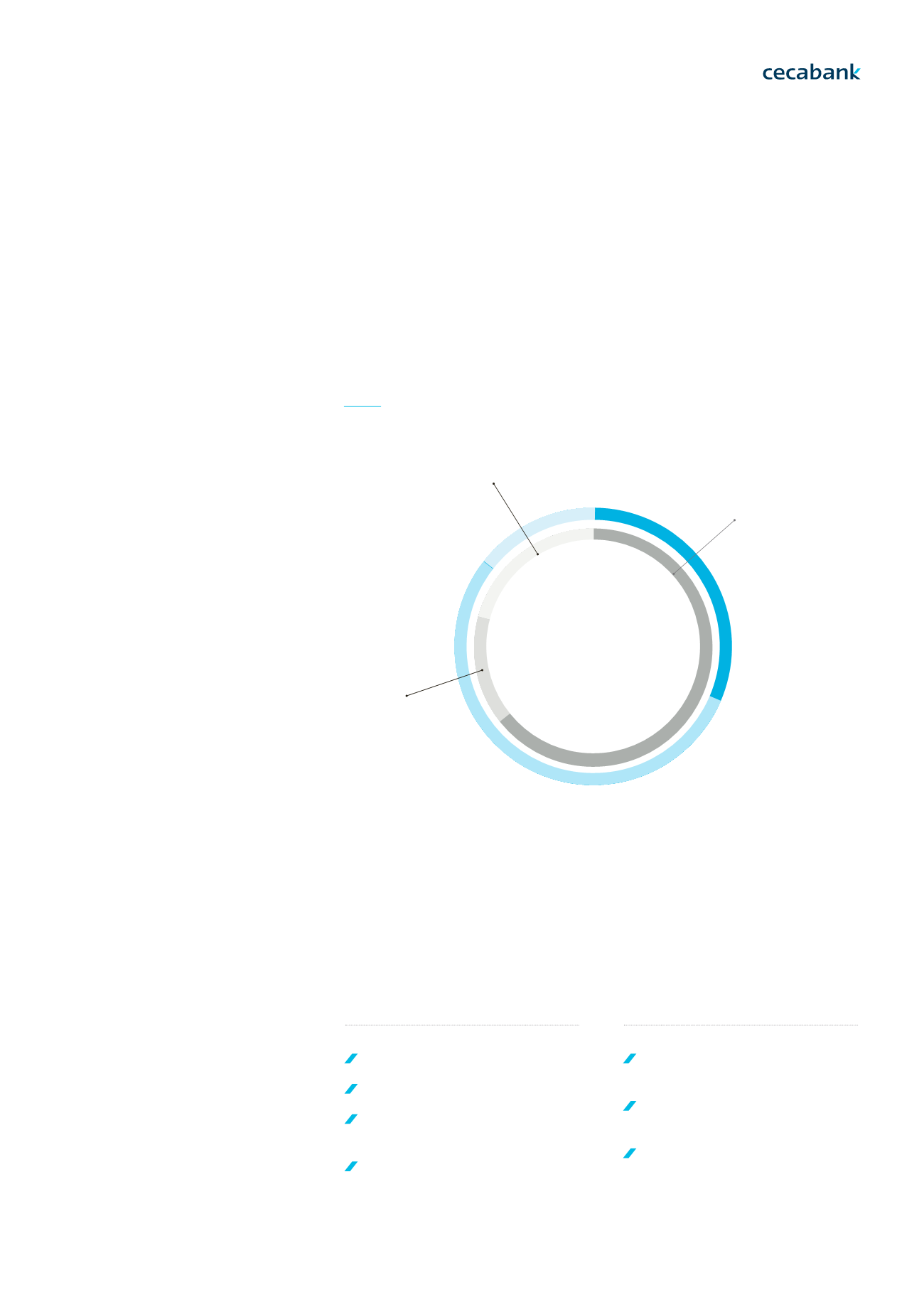

Since 2012 the client base has undergone a change in composition, reducing

direct invoicing to CECA member entities and increasing invoicing to other

customers. Collective investment institution managers (IICs), pension fund

managers (FPs), and investment firms (ESIs) have come to represent the most

prominent segment of the customer portfolio (from 16 per cent in 2012 to 54

per cent in December 2016).

Change Management

Quality Plan

Communications plan

Management development

plan (DEDICA)

CSR Plan

Adapt the organisation

Review Internal and Corporate

Governance

Reduce capacity (no. of

employees)

Mechanise processes and

present a Systems Plan

EVOLUTION OF TURNOVER BY CLIENT TYPE

Fees and other operating income

Investment fund,

pension fund, and ESI

fund managers have

come to represent

the most prominent

segment of the

customer portfolio.

Cecabank has succeeded

in moving towards a

new corporate culture,

with a greater focus on

customers and results.

15%

Traditional

client base

Managers and

ESIS

Other

31

%

16

%

54

%

21%

64

%

2012

2016

Page. 18

Cecabank

2016 Annual Report

1.1

. Strategic Plan: We reach the end of a cycle.1.

2. Main achievements | Improvement of key ratios | Consolidation of the business model | Diversification of income | Diversification of client base | New corporate culture1.

3. 2017-2020 Strategic Plan | Structure | Objectives01 2013-2016 STRATEGIC PLAN