P.

43

Cecabank Report 2018

Corporate Culture

Structure and organization

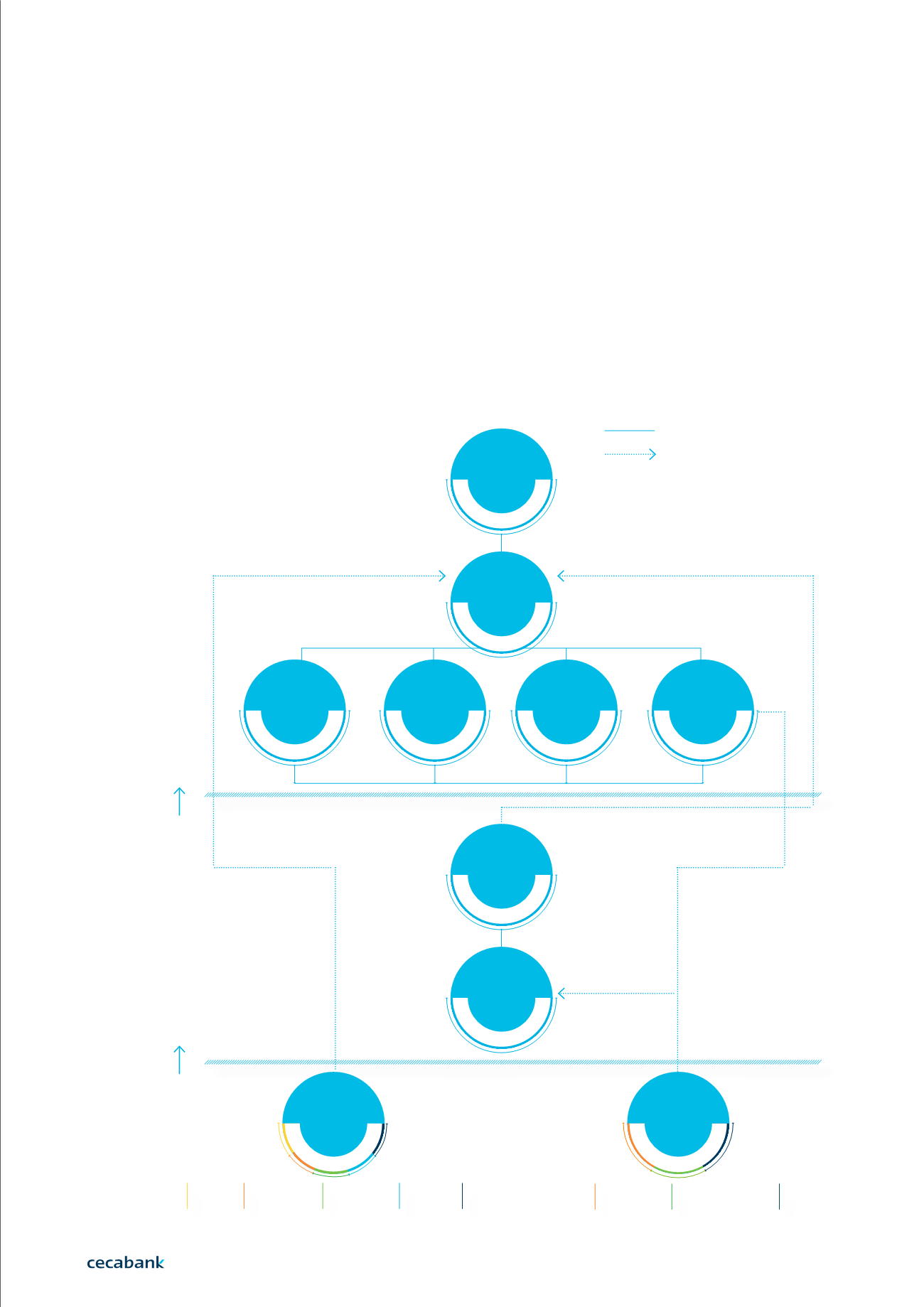

The internal government’s outline allows suitably identifying the risk

assumed by the institution, as well as their management and control. For

the monitoring of the implementation of management policies and the

monitoring of risk profiles, Cecabank has established a supporting structure

and a reporting system as described in the following organisational chart.

3 | 3.2

Disruption,

diversification

and dynamisation

Committee

MOST IMPORTANT BODIES

from the point of view of risk

management

Hierarchical dependence

Line of reporting

Liquidez

General

Shareholders

Committee

CEO

Liquidity

Board

of Directors

Steering

Committee

Risk

Committee

Remuneration

Committee

Appointments

Committee

Audit

Committee

Compliance and

Operational Risk

Committee

Financial

Risks

Committee

Financial Area

Investment

Committee

Technological

Risk and

Global Security

Committee

Committee for the

Prevention of Money

Laundering and the

Financing of Terrorism

Fiscal

Committee

New

Financial

Products

Committee

Liquidity

Contingency

Committee

Assets and

Liabilities

Committee