Page. 32

1. Strategic lines|

Economic and regulatory enviroment|

Building the future|

Business lines 2. Financial information|

Activity|

Income Statement | Capital base|

Ratings 3. Business risk|

The risk function at Cecabank03 Our Business Model

Cecabank

2015 Annual Report

Interest rates

The financial context was marked by expansive

monetary policies continuing to be applied by the main

Central Banks but interest rates are expected to be

divergent in the short and medium term:

In the USA, the Fed initiated an upward interest

rate cycle, with an increase of 0.25 percentage

points in December as growth and employment

rates improved. Once the uncertainty surrounding

the date of monetary normalization disappeared,

the markets focused on the rhythm of the Fed’s

subsequent increases.

In Europe, the ECB wanted to stimulate the

European economy in order to meet its inflation

targets. Thus, at the last meeting in December,

Mario Draghi announced the extension of the

asset purchase programme until March 2017,

besides other measures such as including regional

government and local councils’ debt assets

denominated in euros and the reduction of the

deposit facility to -0.30 per cent.

The continuation of the expansive European

monetary policy will create a favourable

financial environment for the Spanish economy,

characterized by abundant liquidity, a lower

risk premium and a weak euro. However, this

environment will not be risk free and these risks are

associated with the reaction of the main emerging

markets to U.S. monetary normalization and with

the growing geopolitical tensions.

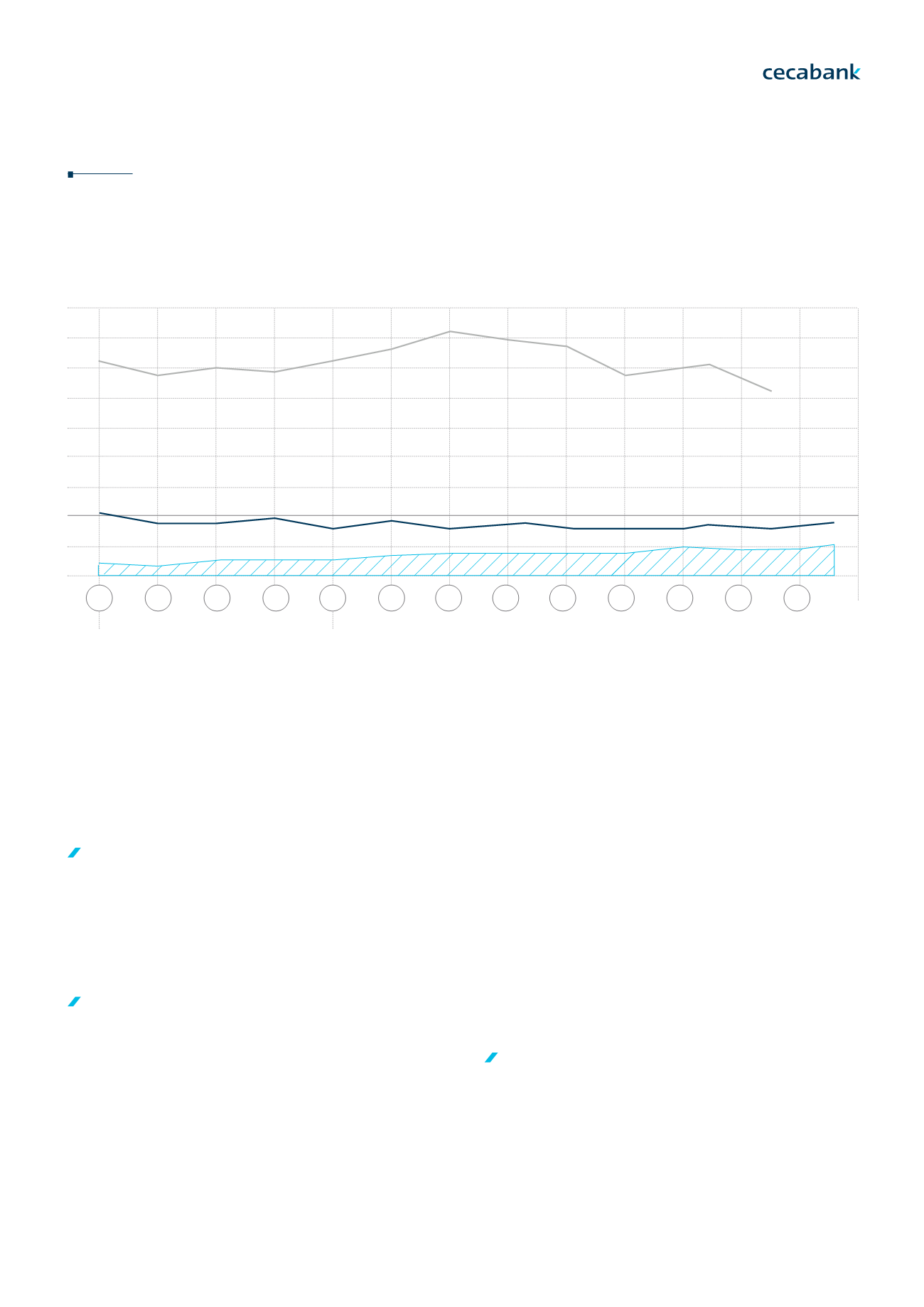

Retail banking

In 2015 Spanish banks ran their businesses in a

context of moderate economic growth and high

unemployment rates and they will have to continue to

work with very low interest rates and increasing

regulatory pressure:

Despite the increase in new funding granted, the

balance of bank loans to the private sector continued

to fall, to reach -4.3 per cent in December.

Off-balacne-sheet funds

Loans

Deposits

9

10

11

12

1

2

3

4

5

6

7

8

9

2014

%

30

25

20

15

10

5

0

-5

-10

2015

Loans and retail funds