Page. 33

Cecabank

2015 Annual Report

The bad debt rate continues to fall, as it has since

the beginning of 2014, but it is still around 10 per

cent, above the European average.

The low return on time deposits continued to

lead to a move away from these instruments

towards off-balance-sheet funds and particularly

investment funds. In 2015, the assets accumulated

in investment funds in the first twelve months of

the year increased by some 25 billion to reach 220

billion, the highest figure since February 2008.

Theprolongationof ascenarioof very low interest rates

is leading to a much narrower net interest margin,

which has only been partially offset by the efficiency

gains associated with restructuring. Consequently,

attaining sustainable profitability levels is one of

banks’ main concerns and, in some cases, this means

re-orientating their business strategies to adapt to the

new economic and regulatory environment.

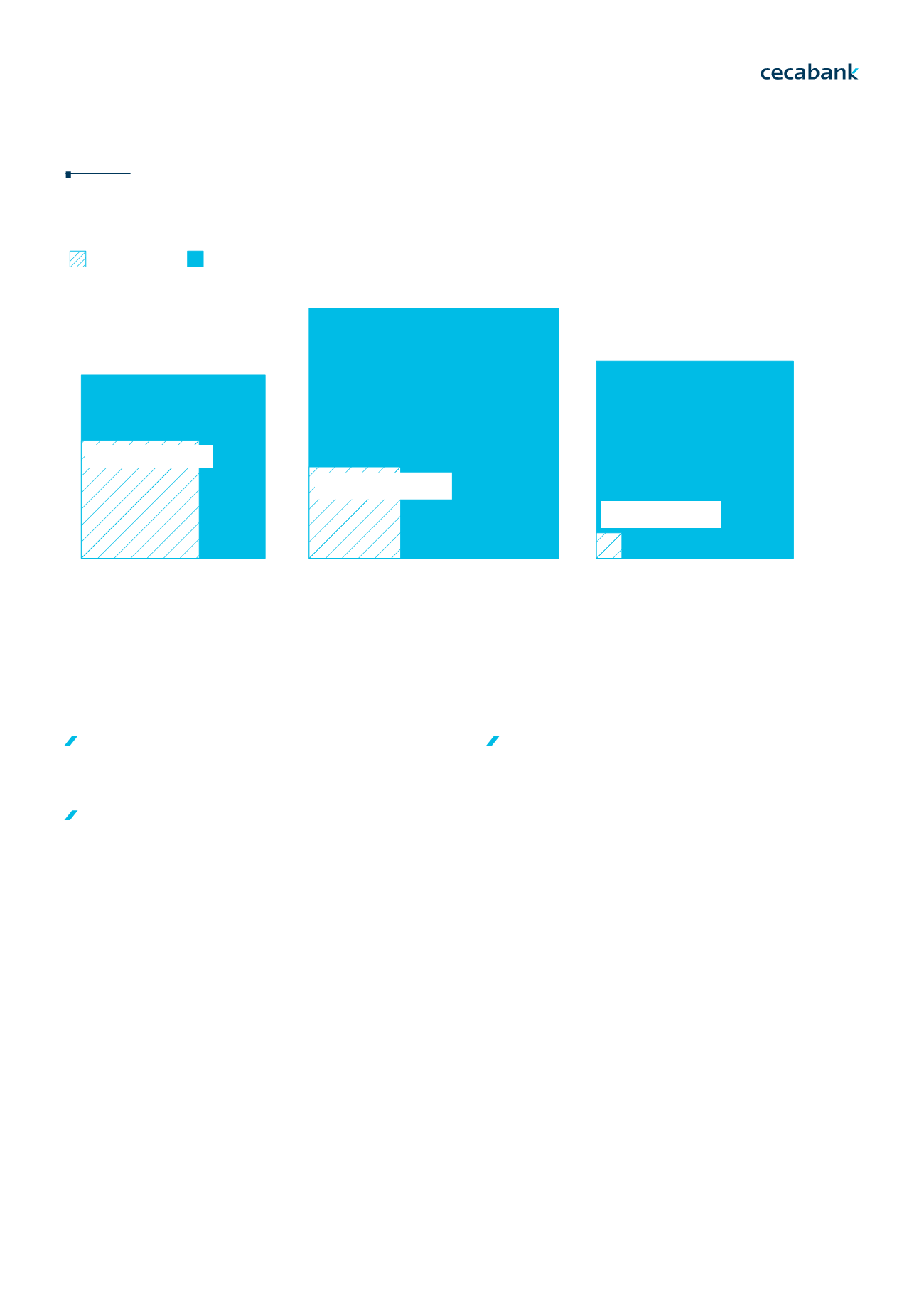

Net subscriptions

Appreciation

Investment funds. Change in assets

Accumulated from January to November

Source: Inverco

2013

+8,000

M. euros

+20,000

M. euros

2014

+5,000

M. euros

+35,000

M. euros

+300

M. euros

2015

+20,000

M. euros

1. Strategic lines | Economic and regulatory enviroment | Building the future | Business lines 2. Financial information | Activity | I ncome Statement | Capital base | R atings 3. Business risk | T he risk function at Cecabank03 Our Business Model