The bank is the Iberian leader in post-trading services. At the close of 2022 it had assets under custody totalling €275,376 million and deposited equity in excess of €202,000 million

Cecabank promotes a technological innovation plan through to 2025 to offer more features to customers

The bank closes the financial year with a CET1 solvency ratio of 30.8%, one of the highest in the system

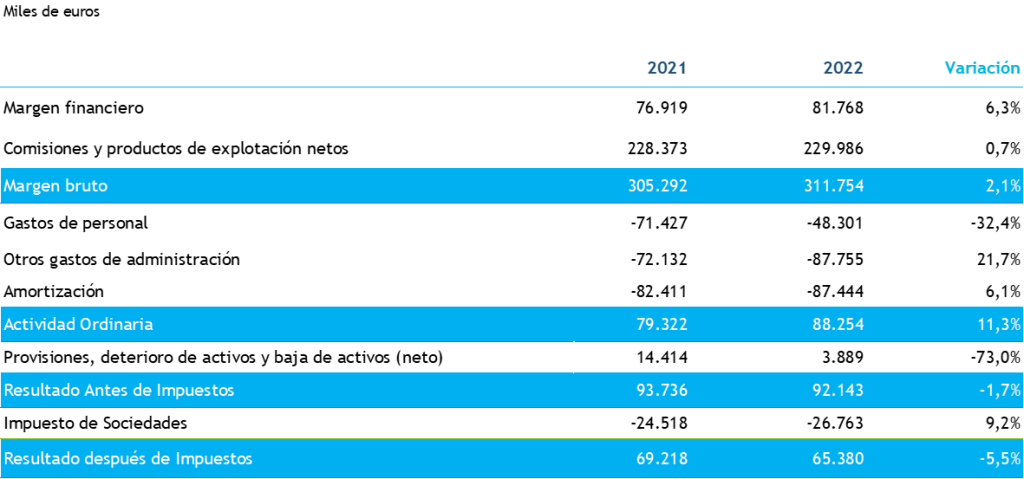

MADRID, 3 APRIL 2023.- Cecabank, the Spanish wholesale bank offering specialised services in securities, treasury management and payments, has presented its results for the 2022 financial year. Net profit totalled €65.4 million, thanks to a 2.4% increase in revenues and a 1.2% reduction in operating expenses. This figure, however, is 5.5% lower than the results obtained in 2021, mainly due to Cecabank's firm commitment to invest in technological innovation projects to offer more features to its customers.

The financial margin increased to €81.8m, which is 6.3% higher than in 2021, driving revenue growth during this period. This increase, coupled with the reduction in operating expenses, drove Cecabank's profit from ordinary activity to €88.3 million, an 11.3% increase over the previous year, the highest figure in the last seven years.

Throughout 2022, Cecabank has embarked on 19 technology transformation initiatives as part of the 2022-2025 Technology Plan, geared towards boosting the business, generating efficiency and enhancing operational resilience. The plan constitutes a fundamental pillar of the bank and a key lever in its strategy to offer the best services to its customers.

Cecabank continues to boast one of the highest solvency ratios in the system and closes the financial year with a CET1 ratio of 30.8%, consistent with its custodian bank business model.

In the words of José María Méndez, CEO of Cecabank: "The results obtained in 2022 reinforce Cecabank's position as a benchmark partner for introducing efficiency into the Spanish financial system, while reflecting our firm commitment towards technological innovation. In line with this commitment, we have increased our investment in R&D&I and driven the development of various technological projects with the aim of expanding the portfolio of value-added services to our customer base".

2022, year of growth in the services of Payments

In the last year, the field of Payments has experienced significant growth. On the one hand, the reactivation of consumption following the confinement due to the pandemic and the increasing substitution of cash by alternative forms of payment, such as cards or immediate transfers, meant that the number of card transactions processed at Cecabank grew by just over 30% in the year. Meanwhile, in both Payments and Technology Platforms, this year the bank has extended the range of services offered and added new customers.

This line of business has gradually consolidated itself to transform Cecabank into a hub specialising in flexible and innovative solutions for card payment processing, e-commerce and mobile payment, backed by many years of experience. By way of example, more than 1,300 million card transactions and 120 million Bizum transactions have been processed in 2022.

For its part, the Treasury business has found new opportunities in 2022 to increase the financial margin in an environment marked by inflation and rising interest rates, while preserving the bank's solvency and a comfortable liquidity position.

Cecabank engages in transactions in the main national and international fixed income (public and private), foreign exchange, equity and derivatives markets. In particular, in the FX segment it is one of the leading players in the domestic market. The bank is a direct member of the leading Central Clearing Houses and a market maker in public debt, NextGeneration EU and, as of 2022, in futures in organised markets for the xRolling FX product.

The bank is the Iberian leader in Securities Services, which encompasses all post-trading services for negotiable securities and financial instruments such as depositary, registry-custody, clearing and settlement, as well as other value-added services related to securities. At year-end 2022, it had assets under custody totalling €275,376 million and €202,000 million in deposited equity.

This year it successfully implemented a major digital transformation process, extending the value chain of this business, taking advantage of the opportunities presented by the new market realities and providing innovative solutions for customers.

In 2022, new customers have been added and many of the existing customers have strengthened their business relationship. In addition, the catalogue of services has been expanded, the platform addressing the requirements established by MiFID II for the marketing of assets in the network has been consolidated and, additionally, the bank has collaborated with fund managers and marketers in the process of designing and implementing the operational integrations derived from the merger of fund managers.

Cecabank, ten years introducing efficiency into the Spanish financial system

Cecabank was founded in 2012 with an innovative business model, providing specialised services, and closed that financial year with a profit of €34.6 million. Ten years later, the bank has posted a profit of €65.4 million, almost double the figure recorded a decade ago.

Today, it is a bank that enjoys market recognition, providing financial and technological services to credit institutions, as well as to collective investment scheme management companies, venture capital firms, insurance companies and investment services firms. In only ten years it has become the Iberian leader in custody and depositary services. When the bank was founded, it held assets under custody worth €94,000 million, and at the end of 2022, assets worth €275,376 million. From a core capital ratio of 13.8% in 2012, it has moved to a CET1 of 30.79% in 2022, among the highest in the market. This level of solvency is significantly higher than the legal requirements and the market average, which contributes to customer confidence.

In short, the bank has become a key player in the Spanish financial system thanks to the trust placed in it by its customers by delegating to it tasks in which it specialises so that they can focus on servicing their customers. Cecabank is working to further increase critical mass in order to introduce more efficiencies. Its success will also be the success of the Spanish financial system.